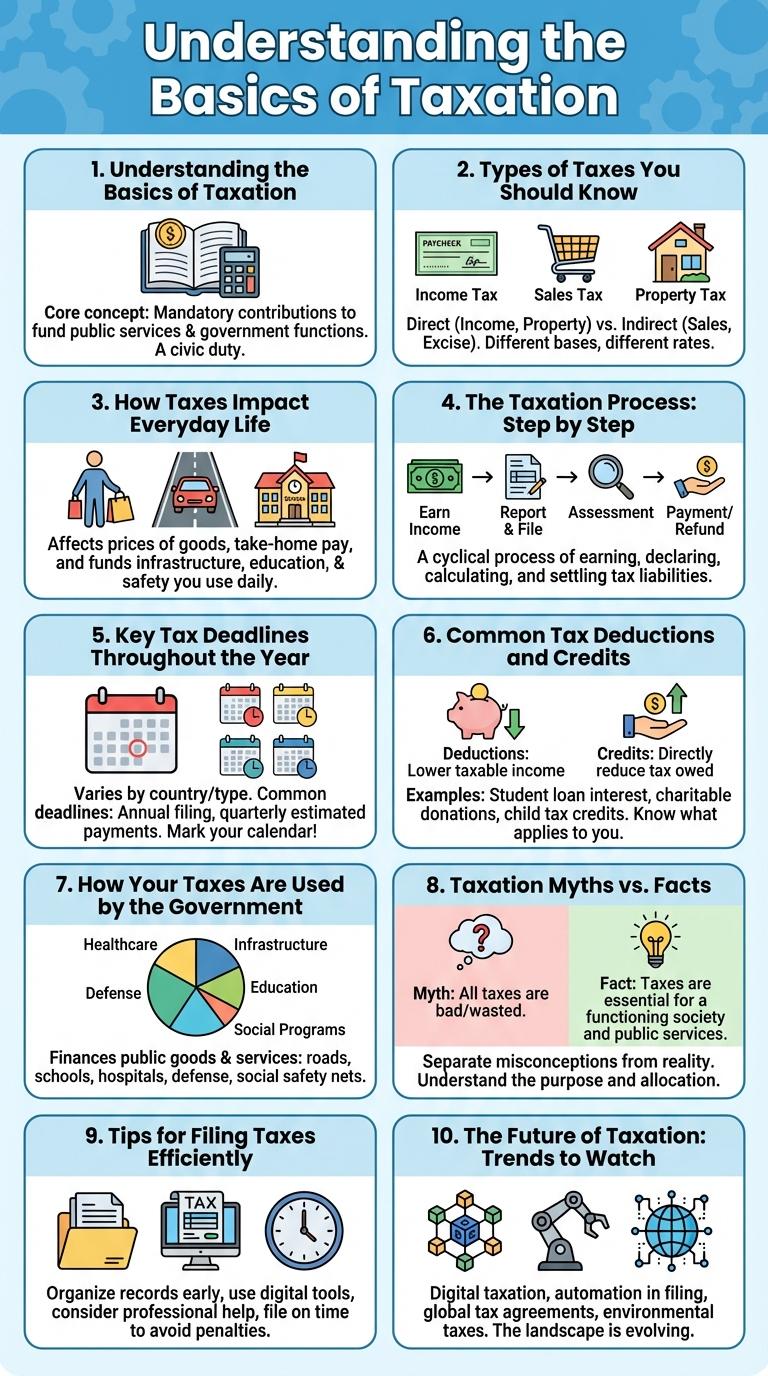

Taxation plays a crucial role in funding public services and infrastructure that support societal growth. Understanding tax systems and their impact helps individuals and businesses make informed financial decisions. Visualizing key tax concepts through an infographic simplifies complex information for better comprehension.

Understanding the Basics of Taxation

Taxation is the process by which governments collect revenue to fund public services and infrastructure. It involves imposing financial charges, known as taxes, on individuals and businesses based on their income, property, or transactions.

Understanding different tax types, such as income tax, sales tax, and property tax, is essential for financial planning and compliance. Tax laws vary by country and region, impacting how taxes are calculated and collected.

Types of Taxes You Should Know

Understanding different types of taxes is essential for effective financial planning. Taxes impact both individuals and businesses in various ways depending on their nature and application.

- Income Tax - A tax imposed on individual and corporate earnings by the government.

- Sales Tax - A consumption tax charged on the sale of goods and services.

- Property Tax - A levy on property ownership, typically based on the property's value.

- Payroll Tax - Taxes withheld from employees' wages to fund social security and Medicare.

- Capital Gains Tax - Tax on the profit from the sale of assets like stocks or real estate.

How Taxes Impact Everyday Life

Taxes shape the infrastructure and services people use daily. Understanding tax impact reveals how public funds support community development.

- Public Services Funding - Taxes finance essential services such as education, healthcare, and emergency response.

- Infrastructure Maintenance - Collected taxes ensure roads, bridges, and public transportation remain functional and safe.

- Social Programs Support - Taxes provide resources for welfare programs that assist vulnerable populations.

The Taxation Process: Step by Step

How does the taxation process work step by step? Understanding the taxation process helps individuals and businesses comply with tax laws efficiently. This guide breaks down the essential stages involved in taxation.

| Step | Description |

|---|---|

| 1. Income Identification | Taxpayers determine all sources of income, including salaries, dividends, and business revenue. |

| 2. Record Keeping | Maintaining accurate financial records is critical for calculating taxable income and deductions. |

| 3. Tax Calculation | Using relevant tax laws, taxpayers compute owed taxes based on income minus allowable deductions and credits. |

| 4. Filing Tax Return | Tax returns are submitted to the tax authority by the designated deadline, outlining income and tax owed. |

| 5. Payment and Compliance | Tax payments are made, and taxpayers may undergo audits to ensure accuracy and adherence to tax codes. |

Key Tax Deadlines Throughout the Year

Understanding key tax deadlines throughout the year helps individuals and businesses stay compliant and avoid penalties. Timely filing and payment are essential for effective financial management.

- January 15 - Estimated Tax Payment Due - Fourth quarter estimated tax payments for the previous year must be submitted by this date.

- April 15 - Individual Tax Return Deadline - The deadline for filing individual tax returns and making any remaining tax payments.

- June 15 - Mid-Year Estimated Tax Payment - Second quarter estimated tax payments for the current year are due by this date.

- September 15 - Third Quarter Estimated Payment - Deadline for submitting the third quarter estimated tax payment for the current year.

- October 15 - Extended Filing Deadline - Final deadline for taxpayers who filed for an extension to submit their individual income tax returns.

Keeping these deadlines in mind ensures compliance and optimal tax planning throughout the year.

Common Tax Deductions and Credits

| Tax Deductions | Description |

|---|---|

| Mortgage Interest | Interest paid on home loans deductible up to a limit. |

| Charitable Donations | Contributions to qualified organizations reduce taxable income. |

| Medical Expenses | Eligible medical costs exceeding a percentage of adjusted gross income. |

| State and Local Taxes (SALT) | Deductions on state income, sales, and property taxes, capped annually. |

| Student Loan Interest | Interest paid on qualified student loans deductible up to $2,500. |

| Tax Credits | Description |

|---|---|

| Earned Income Tax Credit (EITC) | Refundable credit for low to moderate-income working individuals and families. |

| Child Tax Credit | Credit per qualifying child, reducing tax liability dollar-for-dollar. |

| American Opportunity Credit | Credit for qualified education expenses during the first four years of higher education. |

| Lifetime Learning Credit | Credit for qualified tuition and related expenses for undergraduate, graduate, and professional degrees. |

| Saver's Credit | Credit for contributions to retirement savings plans by eligible taxpayers. |

How Your Taxes Are Used by the Government

Taxes fund essential government services such as education, healthcare, and infrastructure development. A significant portion supports public safety, including police and fire departments. Social programs and national defense also receive substantial government tax allocations.

Taxation Myths vs. Facts

Taxation is often misunderstood, leading to common myths that obscure its true purpose. Understanding the facts about taxation helps individuals make informed decisions about their finances and civic responsibilities.

Myth: High taxes always harm economic growth. Fact: Well-structured taxes fund essential public services that support long-term economic stability and development.

Myth: Only the wealthy pay taxes. Fact: Taxes are paid by a broad spectrum of individuals and businesses, funding infrastructure, education, and social programs that benefit everyone.

Tips for Filing Taxes Efficiently

Filing taxes efficiently requires organizing documents such as W-2s, 1099s, and receipts early. Using reliable tax software or consulting a tax professional can help maximize deductions and credits. Keeping track of deadlines and double-checking entries minimizes errors and penalties.