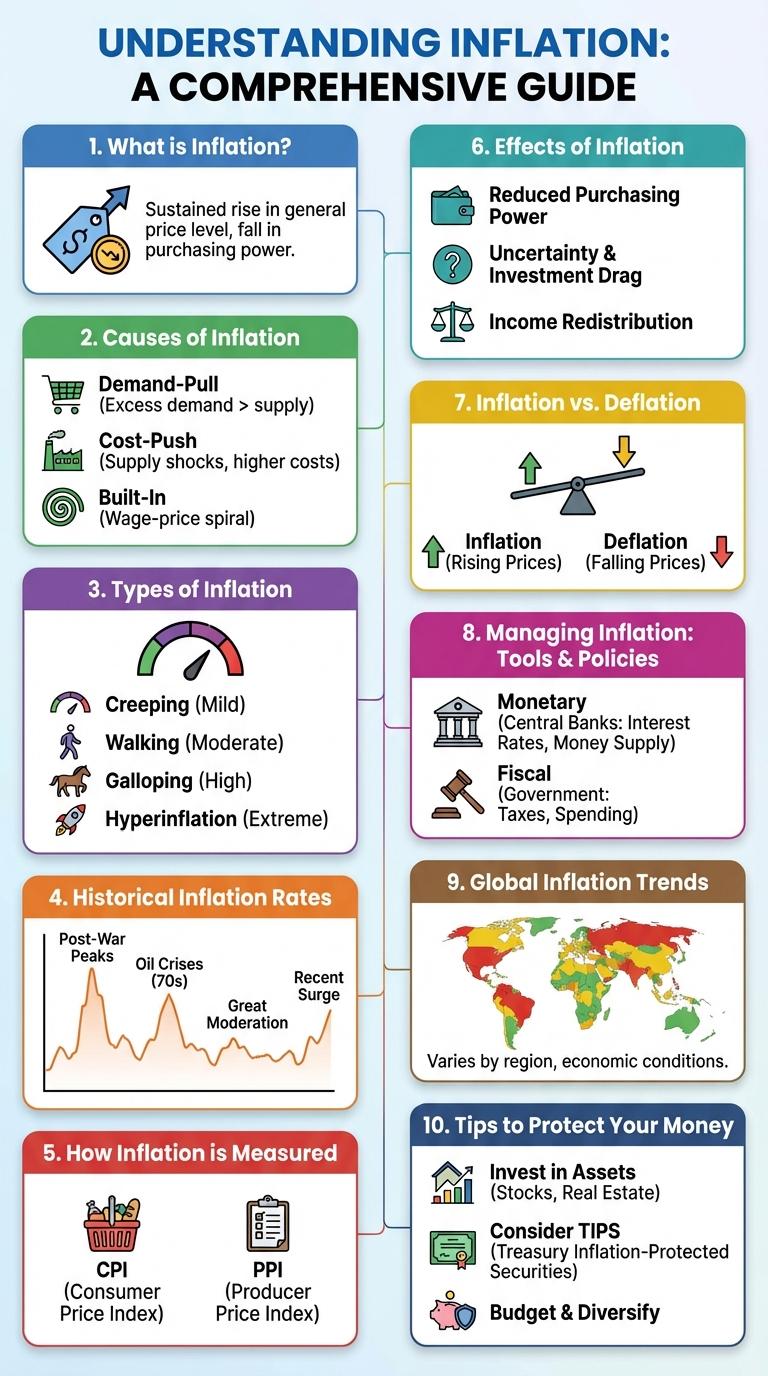

Inflation impacts purchasing power by increasing prices across various goods and services. Understanding inflation trends helps consumers and businesses make informed financial decisions. This infographic visualizes key inflation data to highlight its effects on the economy.

What is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises, causing purchasing power to decline. It reflects how much more expensive items become over time.

Inflation occurs when demand outpaces supply or when production costs increase. Central banks monitor inflation closely to maintain economic stability. Moderate inflation is normal, but high inflation can erode savings and reduce consumer confidence.

Causes of Inflation

Inflation occurs when the general price level of goods and services rises, reducing purchasing power. Understanding the causes of inflation is crucial for economic policy and financial planning.

- Demand-Pull Inflation - Occurs when consumer demand exceeds supply, leading to higher prices.

- Cost-Push Inflation - Results from increased production costs, such as wages and raw materials, driving prices upward.

- Built-In Inflation - Happens when workers demand higher wages to keep up with rising living costs, increasing production expenses.

Recognizing these causes helps in developing strategies to manage and control inflation effectively.

Types of Inflation

Inflation refers to the general increase in prices over time, reducing the purchasing power of money. Different types of inflation include demand-pull inflation, cost-push inflation, and built-in inflation, each caused by distinct economic factors. Understanding these types helps in developing effective monetary policies to manage inflation's impact on the economy.

Historical Inflation Rates

Inflation rates have fluctuated significantly over the past century, influenced by economic cycles, wars, and policy changes. Understanding historical inflation helps gauge the long-term impact on purchasing power and economic stability.

- 1920s Post-War Inflation - Following World War I, inflation surged due to rapid economic adjustments and monetary expansion.

- Great Depression Deflation - The 1930s experienced deflation, with prices falling sharply amid economic contraction and high unemployment.

- 1970s Stagflation - Inflation peaked during the 1970s because of oil shocks and loose monetary policy, leading to stagnant growth with rising prices.

How Inflation is Measured

Inflation is measured using price indices that track the average change in prices of a basket of goods and services over time. The Consumer Price Index (CPI) is the most widely used indicator, reflecting changes in prices paid by urban consumers. Another key measure is the Producer Price Index (PPI), capturing price changes from the perspective of producers at wholesale levels.

Effects of Inflation

Inflation reduces the purchasing power of money, causing consumers to spend more for the same goods and services. This erosion in value affects household budgets and savings, leading to decreased financial security.

Businesses experience increased costs for raw materials and labor, often passing these expenses onto consumers through higher prices. Prolonged inflation can lead to uncertainty in investment and economic growth, impacting overall market stability.

Inflation vs. Deflation

What differentiates inflation from deflation? Inflation refers to the general increase in prices across an economy, reducing the purchasing power of money. Deflation is the opposite, characterized by a sustained decrease in prices, which can increase the value of money.

Managing Inflation: Tools & Policies

Inflation management requires strategic application of monetary and fiscal policies to maintain price stability. Governments and central banks use various tools to control inflation and support economic growth.

- Monetary Policy - Central banks adjust interest rates and control money supply to influence inflation levels.

- Fiscal Policy - Government spending and taxation decisions help regulate demand and curb inflation pressures.

- Inflation Targeting - Setting clear inflation goals guides policy actions for stable and predictable economic conditions.

Global Inflation Trends

Global inflation rates have surged in recent years, driven by supply chain disruptions and increased demand post-pandemic. Many countries are experiencing inflation levels not seen in decades, impacting food, energy, and housing costs.

Emerging markets face higher inflation compared to developed economies due to currency volatility and limited monetary policy tools. Central banks worldwide are adjusting interest rates to combat inflation and stabilize economies.