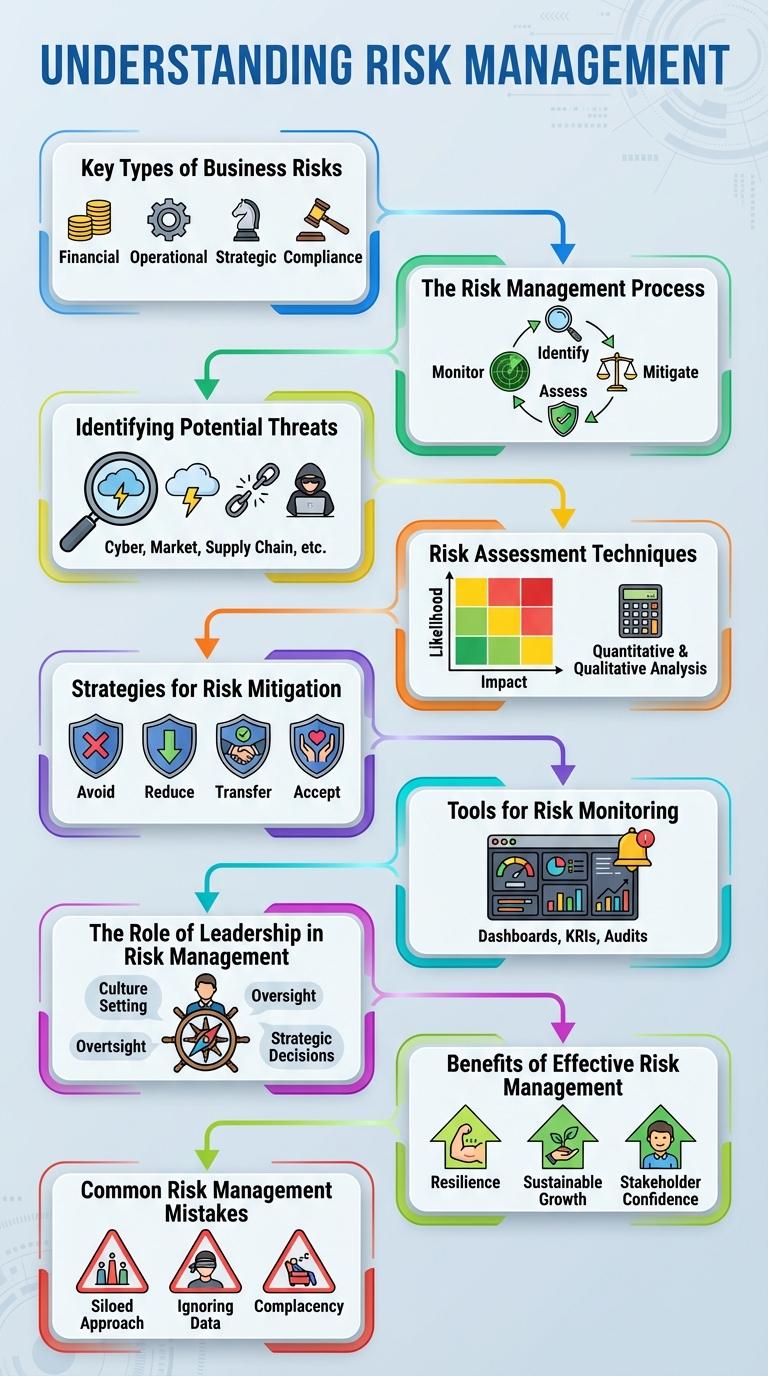

Understanding risk management is essential for identifying, assessing, and prioritizing potential threats to a business or project. This infographic visually breaks down key strategies and tools to mitigate risks effectively. Clear risk management practices enhance decision-making and safeguard organizational success.

Understanding Risk Management

Risk management involves identifying, assessing, and prioritizing potential risks that could impact an organization's objectives. Effective risk management minimizes negative consequences and maximizes opportunities.

Understanding risk management requires knowledge of risk types such as operational, financial, strategic, and compliance risks. Implementing a structured risk management process helps organizations prepare for uncertainties and make informed decisions.

Key Types of Business Risks

Risk management is essential for identifying and mitigating potential threats to business success. Understanding key types of risks helps organizations prepare and respond effectively.

Business risks commonly include strategic, operational, financial, compliance, and reputational risks. Strategic risks involve poor business decisions or changes in the market environment. Operational risks arise from process failures, system breakdowns, or human errors.

The Risk Management Process

Risk management involves identifying, assessing, and prioritizing potential hazards to minimize their impact on an organization. The Risk Management Process consists of risk identification, risk analysis, risk evaluation, risk treatment, monitoring, and communication. Effective implementation ensures informed decision-making and enhanced organizational resilience.

Identifying Potential Threats

Identifying potential threats is a crucial step in effective risk management. It involves detecting risks that could negatively impact a project or organization.

Early identification allows for proactive strategies to mitigate or avoid risks before they escalate.

- Environmental Analysis - Assess external factors like natural disasters or market conditions that could pose risks.

- Stakeholder Consultation - Engage with internal and external stakeholders to uncover hidden or emerging threats.

- Historical Data Review - Analyze past incidents and data trends to predict possible future risks.

Risk Assessment Techniques

Risk assessment techniques are essential tools used to identify, analyze, and evaluate potential hazards that could impact an organization's objectives. These techniques provide a systematic approach to prioritize risks based on their likelihood and potential impact.

Common risk assessment methods include qualitative approaches like risk matrix scoring and quantitative techniques such as Monte Carlo simulation. Implementing these methods helps organizations improve decision-making and allocate resources effectively to mitigate risks.

Strategies for Risk Mitigation

| Strategy | Description |

|---|---|

| Risk Avoidance | Eliminating activities that expose the organization to potential risks, preventing threat occurrence. |

| Risk Reduction | Implementing measures to minimize the impact or likelihood of risks, such as safety protocols and training. |

| Risk Transfer | Shifting risk responsibility to third parties via contracts or insurance policies. |

| Risk Acceptance | Acknowledging risk without taking action, often when cost of mitigation exceeds potential loss. |

| Risk Sharing | Collaborating with partners or stakeholders to distribute and manage risk exposure. |

Tools for Risk Monitoring

Effective risk management relies on continuous monitoring to identify and mitigate potential threats promptly.

Utilizing specialized tools enhances the ability to track risks, assess their impact, and implement timely controls.

- Risk Registers - Comprehensive logs that document identified risks, their status, and mitigation plans for ongoing review.

- Dashboard Software - Visual platforms that provide real-time data on risk metrics and key performance indicators.

- Automated Alerts - Systems configured to notify stakeholders immediately when risk thresholds or triggers are met.

The Role of Leadership in Risk Management

Effective risk management relies heavily on proactive leadership to identify, assess, and mitigate potential threats before they escalate. Leaders drive the development of a risk-aware culture by setting clear policies, promoting transparency, and ensuring accountability across all organizational levels. Their strategic vision and decision-making skills are vital in allocating resources and responding swiftly to emerging risks.

Benefits of Effective Risk Management

What are the benefits of effective risk management? Proper risk management minimizes potential losses and protects organizational assets. It also enhances decision-making by providing clear insights into possible threats and opportunities.