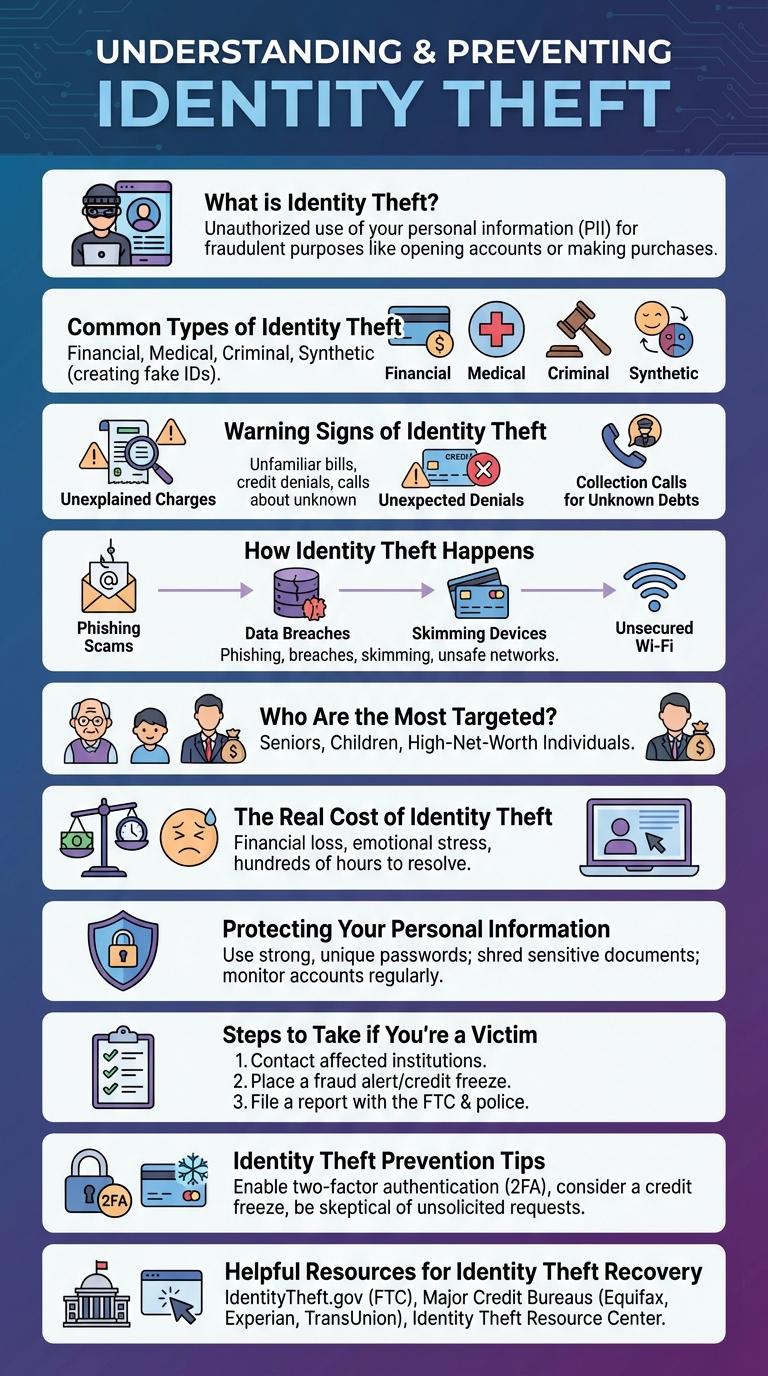

Identity theft occurs when someone illegally obtains and uses another person's personal information, causing financial loss and damage to credit. Understanding common tactics like phishing, data breaches, and social engineering helps individuals protect themselves. This infographic highlights key risks, warning signs, and prevention tips to safeguard your identity.

What is Identity Theft?

Identity theft occurs when someone unlawfully obtains and uses another person's personal information, such as Social Security numbers, credit card details, or bank account data. This crime can lead to financial loss, damaged credit scores, and legal complications for the victim. Protecting personal information and monitoring accounts regularly helps reduce the risk of identity theft.

Common Types of Identity Theft

Identity theft occurs when someone fraudulently obtains and uses another person's personal information. This crime can affect individuals financially and damage their credit reputation.

Common types of identity theft include financial identity theft, where bank or credit card information is stolen. Another frequent form is medical identity theft, involving misuse of health insurance or medical records.

Warning Signs of Identity Theft

Identity theft occurs when someone illegally obtains and uses another person's personal information. Warning signs include unexpected account activity, unfamiliar charges on credit reports, and receiving bills for services not used. Immediate action is crucial to minimize damage and protect your financial security.

How Identity Theft Happens

Identity theft occurs when someone illegally obtains and uses another person's personal information. This crime can lead to financial loss and damage to one's credit reputation.

Understanding the common methods of identity theft helps protect against these threats.

- Phishing Scams - Attackers trick victims into revealing personal data via fake emails or websites.

- Data Breaches - Hackers exploit vulnerabilities in company systems to steal large volumes of sensitive information.

- Skimming Devices - Criminals use electronic devices on ATMs or gas pumps to capture card details.

- Mail Theft - Thieves steal bills, bank statements, or credit cards from mailboxes for identity exploitation.

- Social Engineering - Fraudsters manipulate individuals into disclosing confidential data through deception.

Who Are the Most Targeted?

| Group | Reason for Targeting |

|---|---|

| Seniors (Age 65+) | Often have substantial assets, less tech-savvy, susceptible to scams |

| Young Adults (Age 18-30) | High online activity, use of multiple digital platforms, less security awareness |

| Middle-Income Families | Stable financial status, commonly hold various credit accounts |

| Small Business Owners | Access to business and personal financial data |

| Frequent Online Shoppers | Repeated exposure to e-commerce sites and payment systems |

The Real Cost of Identity Theft

Identity theft causes significant financial damage and emotional stress for victims worldwide. Understanding the real cost helps in prioritizing protection measures and awareness.

- Financial Losses - The average identity theft results in thousands of dollars in direct monetary loss and recovery expenses.

- Time and Recovery - Victims spend an average of over 200 hours resolving identity theft issues with banks and credit agencies.

- Emotional Impact - Stress and anxiety caused by identity theft affect mental health and personal well-being.

Effective prevention and prompt response reduce the long-term consequences of identity theft.

Protecting Your Personal Information

How can you protect your personal information from identity theft?

Keep sensitive documents secure by using locked storage or shredding unwanted papers. Avoid sharing personal details on unfamiliar websites or social media platforms.

What are strong passwords and why are they important?

Strong passwords combine letters, numbers, and symbols to create difficult-to-guess credentials. Using unique passwords for each account reduces the risk of multiple accounts being compromised.

How does two-factor authentication enhance security?

Two-factor authentication requires a second verification step, such as a text message code, to confirm your identity. This extra layer helps prevent unauthorized access even if your password is stolen.

Why should you be cautious about public Wi-Fi networks?

Public Wi-Fi can be insecure, allowing hackers to intercept your personal data. Use a virtual private network (VPN) or avoid accessing sensitive information when connected to public networks.

What signs indicate that your identity might be stolen?

Unexpected credit card charges, unfamiliar accounts, or missing bills can signal identity theft. Monitor your financial statements regularly to detect suspicious activity early.

Steps to Take if You're a Victim

Identity theft can cause significant financial and personal damage. Taking immediate action is crucial to minimize its impact.

First, report the theft to your bank and credit card companies to freeze accounts and prevent fraudulent charges. Next, file a report with your local police and the Federal Trade Commission to create an official record.

Monitor your credit reports from the three major credit bureaus--Equifax, Experian, and TransUnion--regularly for unfamiliar activity. Place a fraud alert or credit freeze to protect your credit profile.

Change passwords and enable two-factor authentication on all important accounts to enhance security. Stay vigilant by reviewing financial statements and accounts frequently for any suspicious activity.

Identity Theft Prevention Tips

Identity theft is a serious crime that can lead to financial loss and damaged credit. Protecting your personal information is essential to avoid becoming a victim.

Regularly monitor your bank and credit card statements for unauthorized transactions. Use strong, unique passwords for all online accounts and enable two-factor authentication. Avoid sharing sensitive information on social media or over unsecured networks.