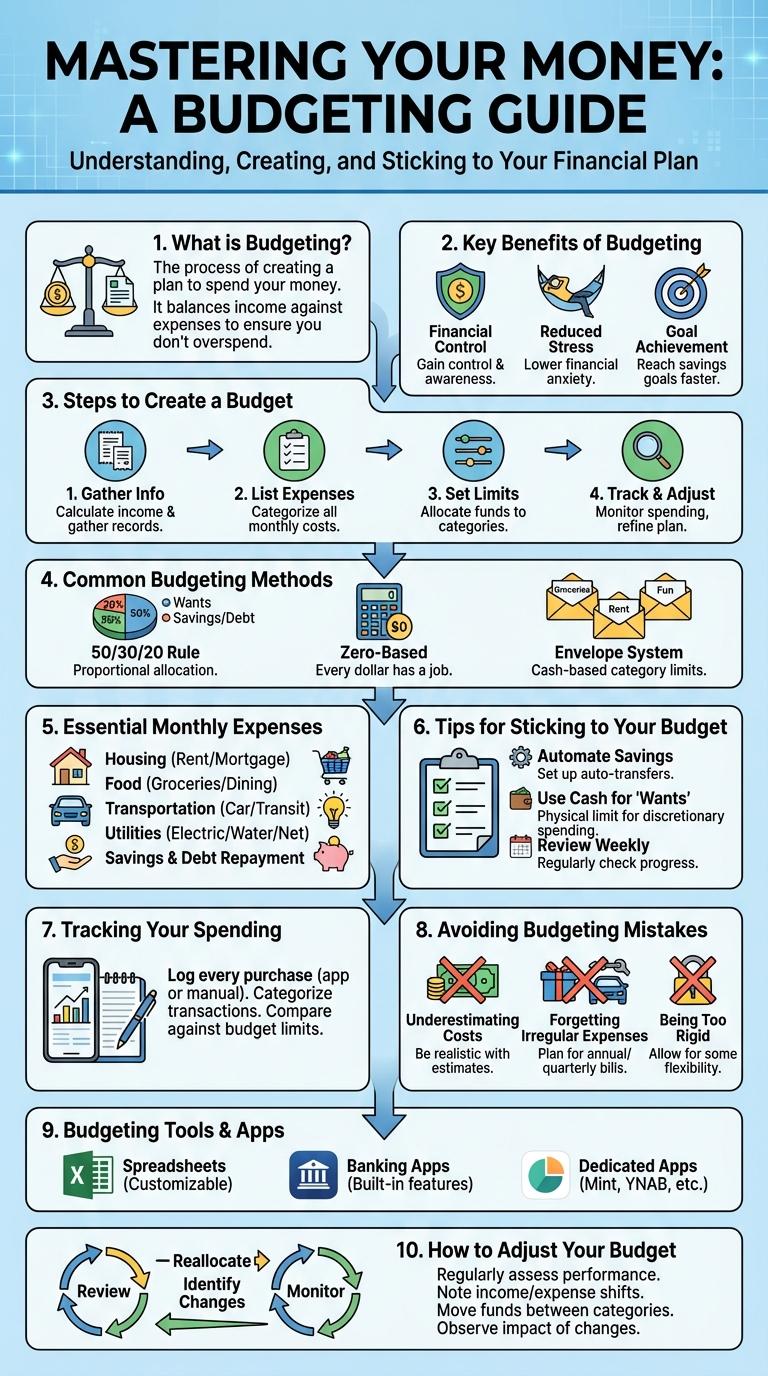

An infographic about budgeting visually breaks down essential financial management tips, making it easier to understand and implement effective money-saving strategies. It highlights key categories such as income allocation, expense tracking, and goal setting to help maintain control over personal finances. Clear visuals and concise data points guide users in creating practical budgets tailored to their needs.

What is Budgeting?

| What is Budgeting? | Description |

|---|---|

| Definition | Budgeting is the process of creating a plan to manage income and expenses effectively. |

| Purpose | Helps track spending, prioritize financial goals, and avoid debt. |

| Components | Income sources, fixed expenses, variable expenses, and savings. |

| Benefits | Improves financial control, encourages saving, and enhances decision-making. |

| Tools | Spreadsheets, budgeting apps, and financial planning software. |

Key Benefits of Budgeting

Budgeting is a fundamental financial tool that helps individuals and businesses manage their money effectively. It promotes financial stability and supports informed decision-making for future expenses.

- Improved Financial Control - Budgeting allows precise tracking of income and expenses, reducing unnecessary spending.

- Debt Reduction - Creating a budget prioritizes debt payments, accelerating the path to financial freedom.

- Goal Achievement - Budgeting aligns spending habits with personal and financial goals, enhancing long-term success.

Steps to Create a Budget

Creating a budget is essential for managing personal finances effectively and achieving financial goals. Following clear steps can simplify the budgeting process and ensure accuracy.

- Assess Income - Calculate all sources of monthly income, including salary, freelance work, and any passive earnings.

- List Expenses - Identify fixed and variable expenses such as rent, utilities, groceries, and entertainment.

- Allocate Funds - Assign specific amounts to each expense category, prioritizing necessities and savings goals.

Common Budgeting Methods

Budgeting is essential for managing personal finances effectively. Selecting the right budgeting method helps individuals control spending and save money.

Common budgeting methods include the 50/30/20 rule, zero-based budgeting, envelope system, and pay-yourself-first approach. Each method offers a unique way to allocate income and track expenses.

Essential Monthly Expenses

Managing essential monthly expenses is crucial for a balanced budget and financial stability. These expenses typically include housing, utilities, food, transportation, and insurance costs.

Tracking and prioritizing these expenses help prevent overspending and ensure bills are paid on time. Allocating funds wisely supports long-term savings and reduces financial stress.

Tips for Sticking to Your Budget

Creating a budget is essential for managing your finances effectively and reaching your financial goals. Focus on tracking your expenses regularly to identify spending patterns and areas where you can cut back. Prioritize needs over wants and set realistic limits to maintain control over your finances and avoid overspending.

Tracking Your Spending

Tracking your spending is essential for effective budgeting and financial control. Use apps or spreadsheets to record all expenses daily, categorizing them for clearer insights. Regularly reviewing your spending patterns helps identify areas to cut costs and increase savings.

Avoiding Budgeting Mistakes

Effective budgeting empowers financial control and goal achievement. Avoiding common mistakes ensures a realistic and sustainable plan.

Track all expenses meticulously to prevent overspending. Set aside an emergency fund to handle unexpected costs. Review and adjust your budget regularly to reflect changes in income or priorities.

Budgeting Tools & Apps

Effective budgeting relies on the right tools to track expenses and manage finances efficiently. Budgeting apps simplify money management by providing real-time insights and automation features.

- Mint - Automatically categorizes transactions and offers personalized budgeting tips based on spending patterns.

- You Need a Budget (YNAB) - Encourages proactive budgeting by assigning every dollar a specific job to optimize financial goals.

- Personal Capital - Combines budgeting with investment tracking to provide a comprehensive view of personal finances.

Choosing a budgeting app depends on individual financial goals, preferred features, and ease of use.