Visualizing money through infographics simplifies complex financial concepts, making them easier to understand and retain. Infographics effectively highlight key data, trends, and statistics related to currency, spending, saving, and investing. This visual approach enhances decision-making by presenting financial information in a clear, concise, and engaging format.

The Evolution of Money

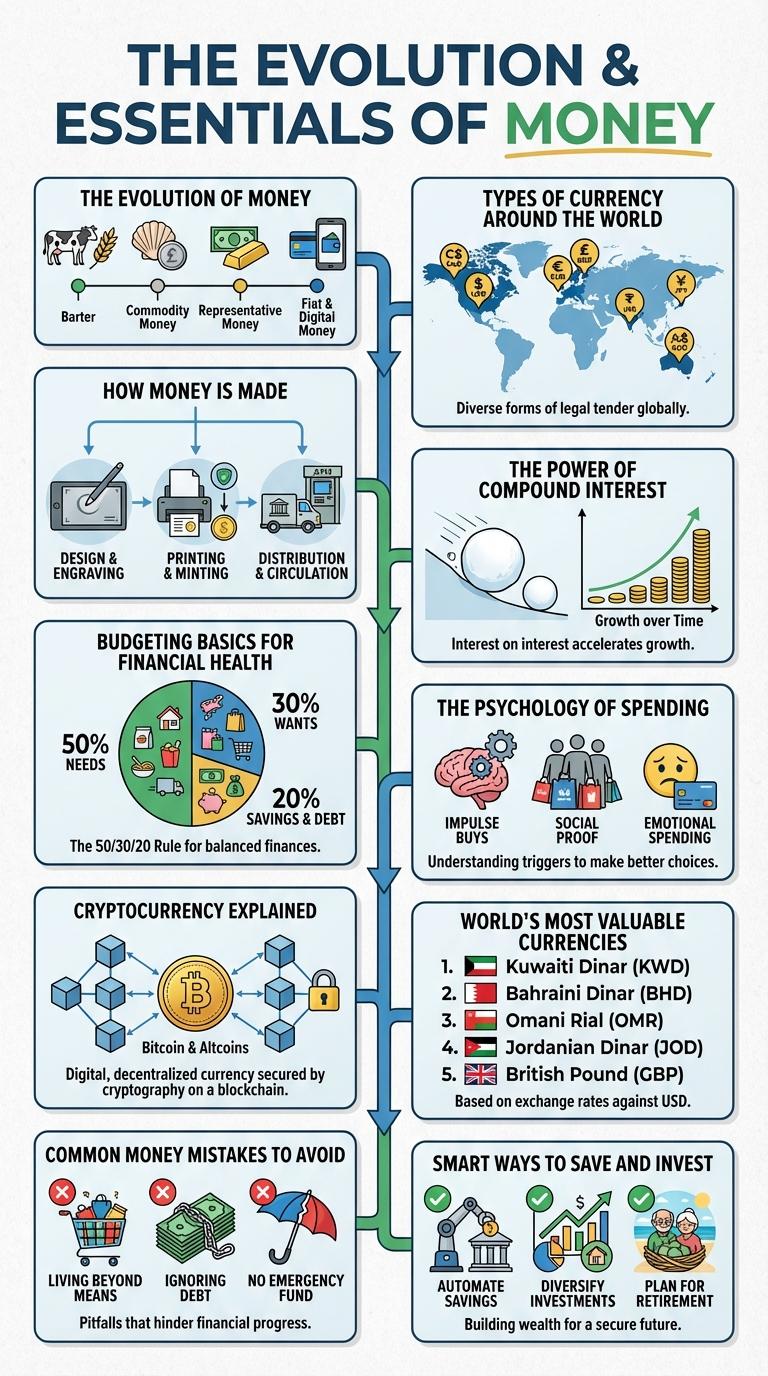

The evolution of money traces the transformation from traditional barter systems to modern digital currencies. This shift highlights society's need for efficient and universally accepted mediums of exchange.

Ancient civilizations used commodity money like shells and precious metals, which later gave way to coinage and paper currency. Today, electronic payments and cryptocurrencies represent the latest advancements, shaping the future of global commerce.

Types of Currency Around the World

Currency serves as a fundamental medium of exchange in global economies, varying significantly by region and country. Different types of currency reflect cultural, economic, and historical factors unique to each area.

- Fiat Currency - Government-issued money not backed by a physical commodity but accepted as legal tender.

- Cryptocurrency - Digital or virtual currency utilizing cryptography for secure transactions and operable independently of banks.

- Commodity Money - Currency backed by a valuable physical asset like gold or silver historically used before fiat systems.

Currencies evolve with technological advancements and economic policies, influencing global trade and finance dynamics.

How Money is Made

Money is created through a complex process involving both physical production and financial systems. Understanding how money is made reveals the interplay between government authorities and banking institutions.

- Design and Printing - Currency is designed with security features and printed by government mints to prevent counterfeiting.

- Distribution - Printed money is distributed to banks by central banks to enter circulation within the economy.

- Money Creation by Banks - Banks generate money digitally through lending, increasing the money supply beyond physical cash.

The Power of Compound Interest

| Aspect | Details |

|---|---|

| Definition | Compound interest is the process where interest earns interest on both the initial principal and accumulated interest. |

| Growth Effect | Balances grow faster over time compared to simple interest due to exponential accumulation. |

| Key Formula | A = P(1 + r/n)^(nt) where A is amount, P is principal, r is interest rate, n is times compounded per year, t is years. |

| Example | Investing $1,000 at 5% compounded annually grows to $1,628 after 10 years. |

| Importance | Encourages early and consistent investing to maximize long-term wealth accumulation. |

Budgeting Basics for Financial Health

Effective budgeting is the foundation of strong financial health. It helps individuals track income, control expenses, and allocate funds toward savings and investments.

Start by categorizing monthly expenses into essentials, savings, and discretionary spending. Regularly reviewing and adjusting your budget ensures financial goals remain achievable and debt stays manageable.

The Psychology of Spending

Why do people often overspend despite knowing their budget limits?

Spending triggers the brain's reward system, releasing dopamine that creates feelings of pleasure. This psychological response can lead to impulsive purchases and challenges in managing finances.

Cryptocurrency Explained

Cryptocurrency is a digital or virtual form of money secured by cryptography, making it nearly impossible to counterfeit. It operates on decentralized technology called blockchain, which records transactions across multiple computers. Popular cryptocurrencies include Bitcoin, Ethereum, and Ripple, each offering unique features and applications.

World's Most Valuable Currencies

The world's most valuable currencies reflect the economic strength and stability of their respective countries. These currencies are favored in global trade and investment due to their high purchasing power.

The Kuwaiti Dinar (KWD) tops the list as the highest-valued currency, driven by Kuwait's strong oil exports and resource-based economy. The Bahraini Dinar (BHD) and Omani Rial (OMR) follow closely, supported by their affluent economies and oil reserves. Other top currencies include the British Pound Sterling (GBP) and the Swiss Franc (CHF), noted for their historical stability and global trust.

Common Money Mistakes to Avoid

Understanding common money mistakes helps improve financial health and build wealth. Avoiding these errors can lead to better savings and smarter spending habits.

- Overspending - Spending beyond your means reduces savings and increases debt risk.

- Neglecting Budgeting - Failing to track expenses causes poor financial control and missed opportunities.

- Ignoring Emergency Funds - Not saving for emergencies leads to financial instability during unexpected events.