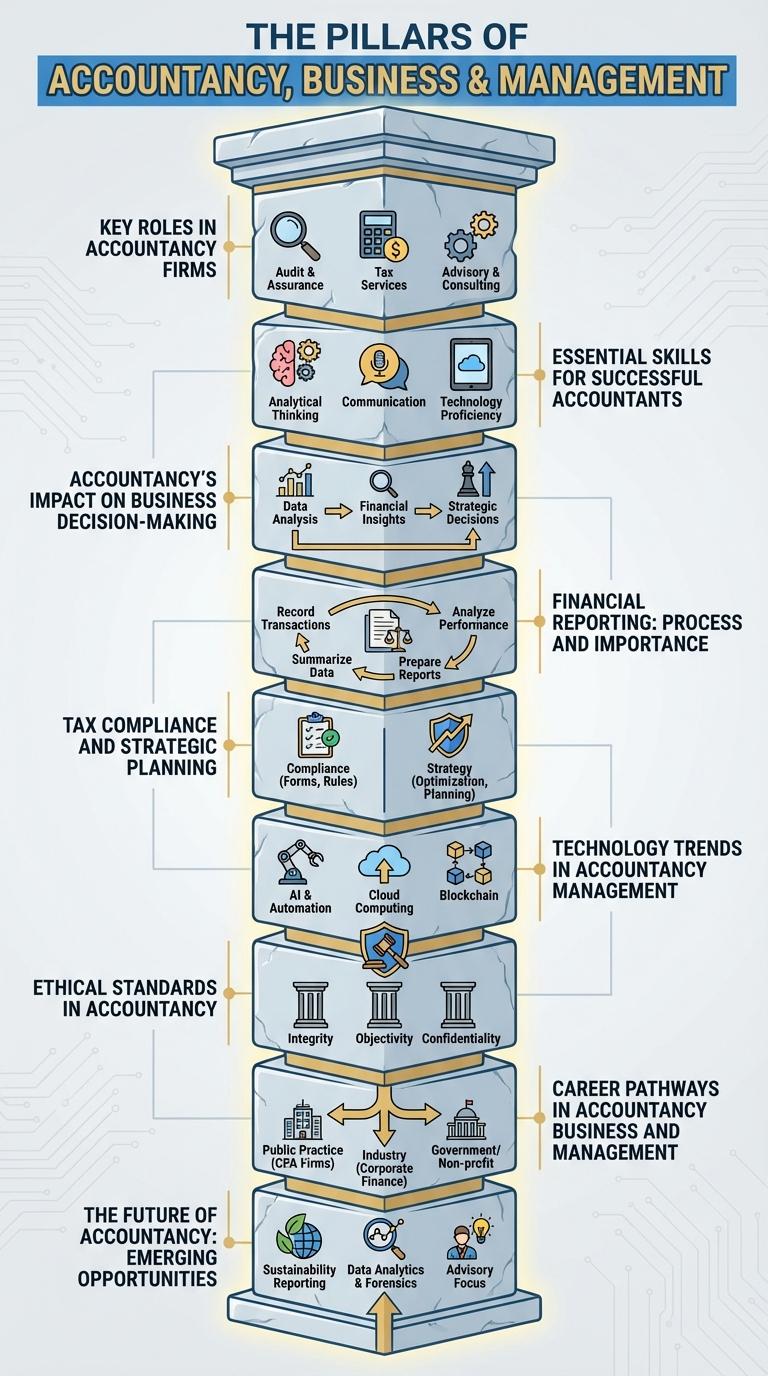

An infographic about accountancy business and management visually presents key data and insights, simplifying complex financial concepts for effective decision-making. It highlights essential practices, trends, and tools that drive efficiency and accuracy in managing financial operations. By combining visuals with concise information, the infographic enhances understanding and supports strategic planning in the accounting field.

The Pillars of Accountancy Business and Management

Accountancy business and management rest on four essential pillars that ensure financial accuracy, regulatory compliance, strategic planning, and client trust. These pillars include Financial Reporting, Tax Management, Auditing, and Consultancy Services. Mastery of these components drives sustainable growth and strengthens organizational integrity.

Key Roles in Accountancy Firms

| Key Role | Main Responsibilities |

|---|---|

| Accountant | Preparing financial statements, recording transactions, ensuring compliance with regulations |

| Audit Manager | Overseeing audit processes, assessing financial accuracy, managing audit teams |

| Tax Consultant | Providing tax advice, tax planning, preparing tax returns, ensuring regulatory compliance |

| Financial Analyst | Analyzing financial data, forecasting trends, advising on investment decisions |

| Management Consultant | Improving business efficiency, advising on strategic management, optimizing operations |

Essential Skills for Successful Accountants

Successful accountants combine technical expertise with strong management skills to excel in their profession. Mastery of essential skills enhances accuracy, decision-making, and client trust.

Key skills include proficiency in financial reporting, analytical thinking, and effective communication. Time management and leadership abilities drive efficient business operations. Adaptability to evolving regulations and technologies ensures sustained success.

Accountancy's Impact on Business Decision-Making

Accountancy plays a critical role in shaping business decision-making by providing accurate financial data and insights. Effective accountancy practices enable organizations to optimize resource allocation and strategic planning.

- Financial Transparency - Accountancy ensures clear and accurate financial reporting, allowing businesses to make informed decisions.

- Risk Management - Accountants identify and analyze financial risks, helping businesses avoid potential losses.

- Performance Measurement - Accountancy provides key performance indicators that guide management in evaluating business success and areas for improvement.

Financial Reporting: Process and Importance

What is the financial reporting process in accountancy business and management? Financial reporting involves collecting, analyzing, and presenting financial data to stakeholders. This process ensures transparency and supports strategic decision-making in businesses.

Why is financial reporting important for businesses? Accurate financial reports provide insights into a company's financial health, enabling management to plan and allocate resources effectively. They also ensure compliance with regulatory standards and build trust with investors and creditors.

Tax Compliance and Strategic Planning

Accountancy businesses integrate tax compliance and strategic planning to drive financial accuracy and growth. These core functions ensure businesses meet legal obligations while optimizing long-term financial performance.

- Tax Compliance - Ensures accurate reporting and timely submission of tax returns to avoid penalties and legal issues.

- Strategic Planning - Involves setting financial goals and designing actionable plans to enhance business value and sustainability.

- Risk Management - Identifies tax-related risks and implements measures to minimize exposure and financial loss.

- Financial Forecasting - Uses historical data and market trends to predict future tax liabilities and cash flow needs.

- Regulatory Updates - Keeps businesses informed about changing tax laws and regulations for continuous compliance.

Technology Trends in Accountancy Management

Technology trends in accountancy management are rapidly transforming how businesses handle financial data and decision-making processes. Innovations such as cloud computing and artificial intelligence are enhancing accuracy, efficiency, and accessibility in accounting tasks.

Automation tools streamline repetitive processes, reducing human error and saving time for accountants. Advanced analytics provide deeper financial insights, enabling better strategic planning and risk management in accountancy businesses.

Ethical Standards in Accountancy

Ethical standards in accountancy are fundamental principles that guide accountants in maintaining integrity, objectivity, and professionalism. These standards ensure transparency and trustworthiness in financial reporting and business management.

Adherence to ethical codes prevents conflicts of interest and promotes accountability in all accounting practices. Ethical accountancy enhances stakeholder confidence and supports sustainable business growth.

Career Pathways in Accountancy Business and Management

Career pathways in accountancy business and management offer diverse opportunities, ranging from junior accountant roles to senior financial managers and CFOs. Professionals develop skills in financial analysis, auditing, taxation, and strategic management to advance their careers. Specializations such as forensic accounting, corporate finance, and consultancy enhance job prospects and industry demand.