An oligopoly is a market structure dominated by a few large firms that hold significant market power, influencing prices and output. These companies often engage in strategic decision-making, where the actions of one firm directly impact the others. Understanding the dynamics of oligopolies is essential for analyzing competitive behavior and market outcomes.

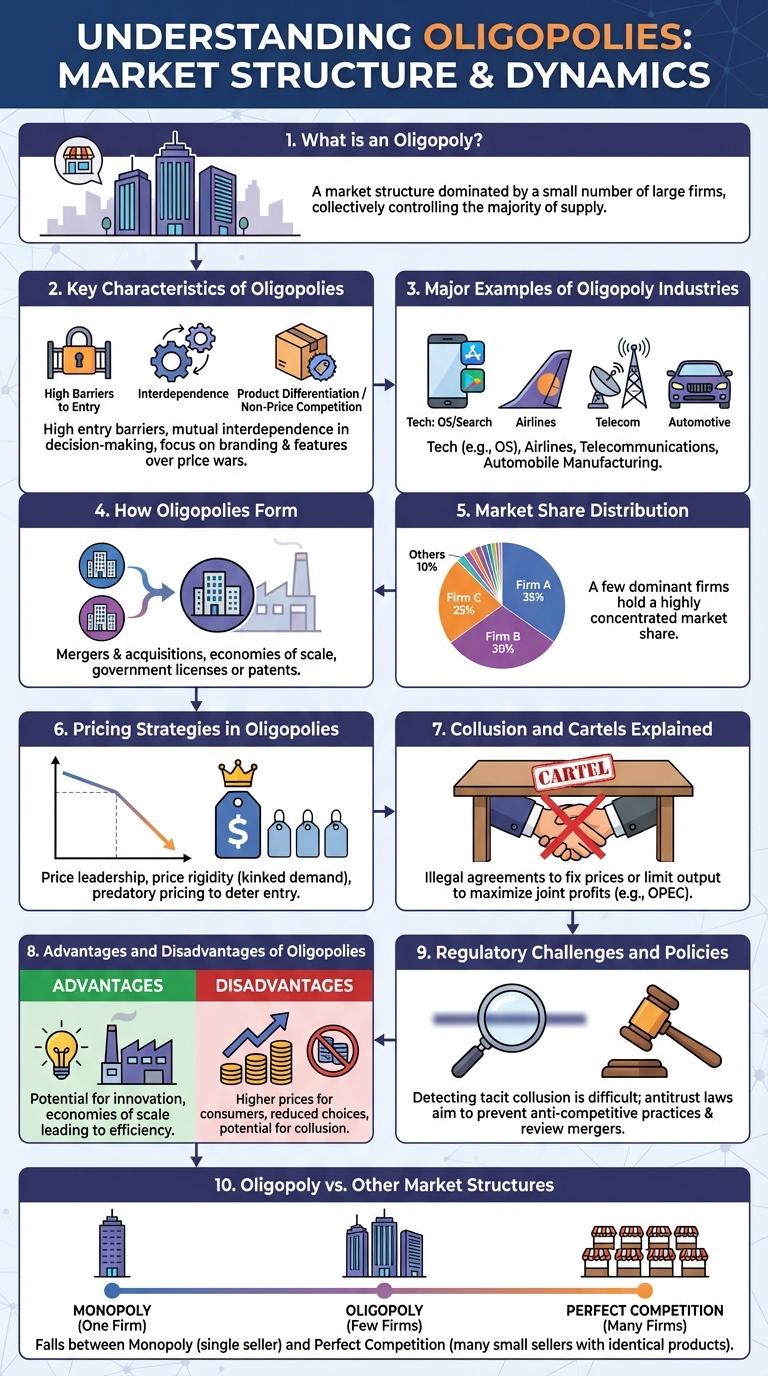

What is an Oligopoly?

An oligopoly is a market structure dominated by a small number of large firms. These firms hold significant market power, influencing prices and output levels.

In an oligopoly, companies often engage in strategic decision-making, considering the potential reactions of their competitors. Barriers to entry are high, limiting competition and promoting market stability.

Key Characteristics of Oligopolies

An oligopoly is a market structure dominated by a small number of large firms, leading to limited competition. These firms hold significant market power, enabling them to influence prices and output levels. Barriers to entry are high, preventing new competitors from easily entering the market.

Major Examples of Oligopoly Industries

An oligopoly is a market structure dominated by a small number of firms, leading to limited competition and significant market power among these companies. Major examples of oligopoly industries include telecommunications, where companies like AT&T, Verizon, and T-Mobile control most of the market. The automotive industry is another example, with key players such as Toyota, Volkswagen, Ford, and General Motors influencing pricing and production decisions.

How Oligopolies Form

Oligopolies form when a market is dominated by a few large firms, limiting competition and controlling prices. These market conditions result from various economic and strategic factors that favor concentrated industry control.

Key factors contributing to the formation of oligopolies include:

- High Barriers to Entry - Significant capital investment and regulatory requirements prevent new competitors from entering the market easily.

- Economies of Scale - Established firms benefit from lower costs per unit, making it difficult for smaller firms to compete effectively.

- Mergers and Acquisitions - Companies consolidate to reduce competition and increase market share, leading to fewer dominant players.

Market Share Distribution

An oligopoly is a market structure dominated by a small number of firms. These firms hold significant market share, influencing prices and output levels.

- Concentration Ratio - Measures the total market share held by the largest firms in an industry, typically the top four or five.

- Market Share Distribution - Shows how market control is divided among the key players in an oligopoly, often unevenly.

- Competitive Impact - High market share concentration limits competition, leading to potential price rigidity and strategic behavior among firms.

Understanding market share distribution helps analyze the competitive dynamics and pricing power within an oligopolistic market.

Pricing Strategies in Oligopolies

Oligopolies consist of a few dominant firms that control the market, leading to interdependent pricing strategies. Firms carefully monitor competitors' prices to avoid price wars that erode profits.

Common pricing strategies include price leadership, where one firm sets prices followed by others, and kinked demand curves causing price rigidity. Non-price competition also plays a crucial role in sustaining market share without triggering aggressive price cuts.

Collusion and Cartels Explained

| Concept | Description |

|---|---|

| Oligopoly | Market structure dominated by a few large firms controlling the majority of market share, resulting in limited competition. |

| Collusion | Informal or formal agreement among oligopolistic firms to set prices, limit production, or divide markets to maximize joint profits and reduce competition. |

| Cartels | Formal organizations of firms within an oligopoly that coordinate actions such as price fixing, output restrictions, and market allocation to maintain high profits. |

| Effects of Collusion and Cartels | Higher prices for consumers, reduced innovation, restricted market entry, and inefficient allocation of resources due to reduced competition. |

| Legal Status | Most countries outlaw cartels and collusion through antitrust laws to promote competition and protect consumers. |

Advantages and Disadvantages of Oligopolies

An oligopoly is a market structure dominated by a small number of large firms. These firms have significant control over prices and market output.

Advantages of oligopolies include stable prices and high profits due to limited competition. Firms in an oligopoly often invest in innovation and product development. However, disadvantages include reduced consumer choice and the potential for higher prices due to collusion or market dominance.

Regulatory Challenges and Policies

What are the main regulatory challenges in managing oligopolies?

Oligopolies pose unique regulatory challenges due to their limited number of dominant firms controlling market share. Preventing anti-competitive behaviors such as price fixing and collusion is a critical focus for policymakers.

How do governments enforce policies to regulate oligopolistic markets?

Governments implement antitrust laws and competition policies to monitor and restrict practices that harm consumer welfare. Regulatory bodies investigate firms and impose penalties to maintain market fairness and promote competition.

What impact do regulations have on innovation within oligopolies?

Regulations can both restrict and encourage innovation by controlling monopolistic tendencies while promoting R&D investment. Effective policies balance market control and incentives for technological advancement.

How do regulatory frameworks differ across countries for oligopoly control?

Regulatory approaches vary, with some countries enforcing stricter antitrust measures and others adopting more lenient oversight. Differences in enforcement intensity and legal provisions influence the competitive dynamics of oligopolistic markets.

What role do consumer protection policies play in oligopoly regulation?

Consumer protection policies aim to safeguard buyers from unfair pricing and limited choices often seen in oligopoly markets. Ensuring transparency and preventing exploitative practices strengthens market efficiency and consumer trust.