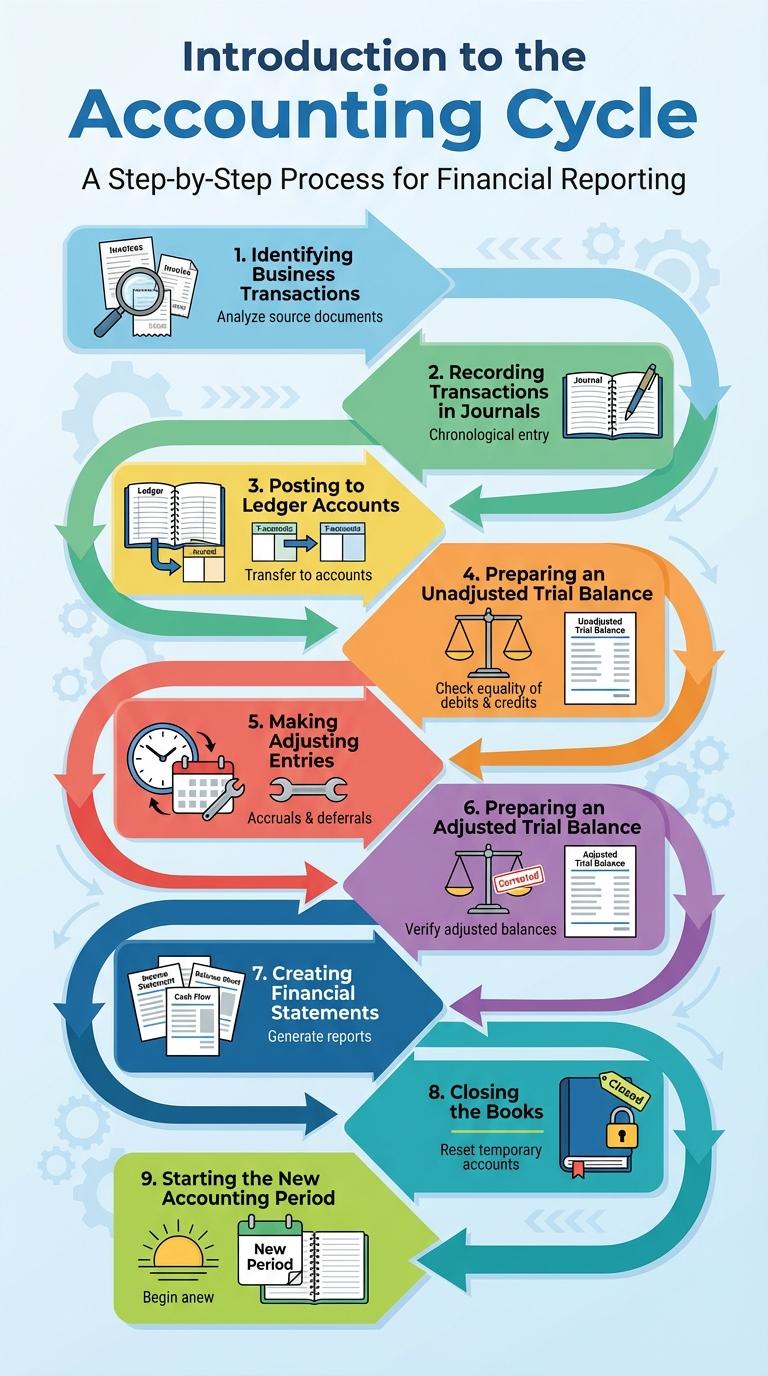

The accounting cycle is a systematic process that ensures accurate financial recording and reporting for businesses. It involves steps such as identifying transactions, journalizing, posting to ledgers, preparing trial balances, and producing financial statements. Understanding each phase of the cycle enhances the accuracy and integrity of financial data.

Introduction to the Accounting Cycle

The accounting cycle is a systematic process used by businesses to record, classify, and summarize financial transactions. It ensures accuracy and consistency in financial reporting over a specific period.

The cycle begins with identifying transactions and ends with the preparation of financial statements. It includes steps such as journalizing, posting to ledgers, and adjusting entries. This process helps organizations maintain clear and organized financial records for decision-making and compliance.

Identifying Business Transactions

What is the first step in the accounting cycle?

Identifying business transactions is the initial phase of the accounting cycle. It involves recognizing and analyzing financial events that impact the company's accounts.

Recording Transactions in Journals

| Step | Description |

|---|---|

| Identify Transactions | Recognize and analyze economic events that impact the company's financial status. |

| Source Documents | Collect invoices, receipts, and other proof of transactions to ensure accuracy. |

| Journal Entry | Record transactions chronologically in the journal, specifying accounts debited and credited. |

| Debit and Credit Rules | Apply double-entry accounting where each debit has a corresponding credit to maintain balance. |

| Post to Ledger | Transfer journal entries to general ledger accounts for summarizing financial data. |

Posting to Ledger Accounts

The accounting cycle involves multiple steps to ensure accurate financial reporting. Posting to ledger accounts is a crucial phase where journal entries are transferred to individual accounts in the general ledger.

This process organizes financial data by account type, enabling effective tracking of transactions. Accurate posting ensures the preparation of reliable trial balances and financial statements.

Preparing an Unadjusted Trial Balance

The accounting cycle begins with recording financial transactions in journals and posting them to ledger accounts. Preparing an unadjusted trial balance involves listing all ledger account balances to verify that total debits equal total credits. This step ensures the accuracy of recorded transactions before making adjusting entries.

Making Adjusting Entries

Making adjusting entries is a crucial step in the accounting cycle, ensuring financial statements reflect accurate and up-to-date information. These entries correct deferrals and accruals to match revenues and expenses to the correct accounting period.

- Purpose - Adjusting entries update account balances before financial statements are prepared.

- Types - Common types include accrued revenues, accrued expenses, deferred revenues, and deferred expenses.

- Timing - Adjustments are made at the end of the accounting period to align income and expenses accurately.

Accurate adjusting entries lead to reliable financial reporting and compliance with accounting principles.

Preparing an Adjusted Trial Balance

The adjusted trial balance is prepared after making all necessary adjusting entries at the end of an accounting period. It ensures that debits and credits are balanced and reflects the accurate financial position of the company.

This step is crucial for detecting errors in the ledger accounts before creating financial statements. It includes updated balances for assets, liabilities, revenues, and expenses after adjustments.

Creating Financial Statements

The accounting cycle culminates in the creation of financial statements, which summarize a company's financial performance and position. These reports provide essential information for decision-making by stakeholders.

- Income Statement - Reports revenues and expenses over a period, revealing net profit or loss.

- Balance Sheet - Presents assets, liabilities, and equity at a specific point in time.

- Cash Flow Statement - Details cash inflows and outflows from operating, investing, and financing activities.

Closing the Books

The closing the books phase finalizes all accounting activities for the fiscal period, ensuring accurate financial statements. This process involves recording closing entries, such as debiting revenue accounts and crediting expense accounts to zero them out. Properly closing the books prepares the accounting system for the next cycle and maintains compliance with financial standards.