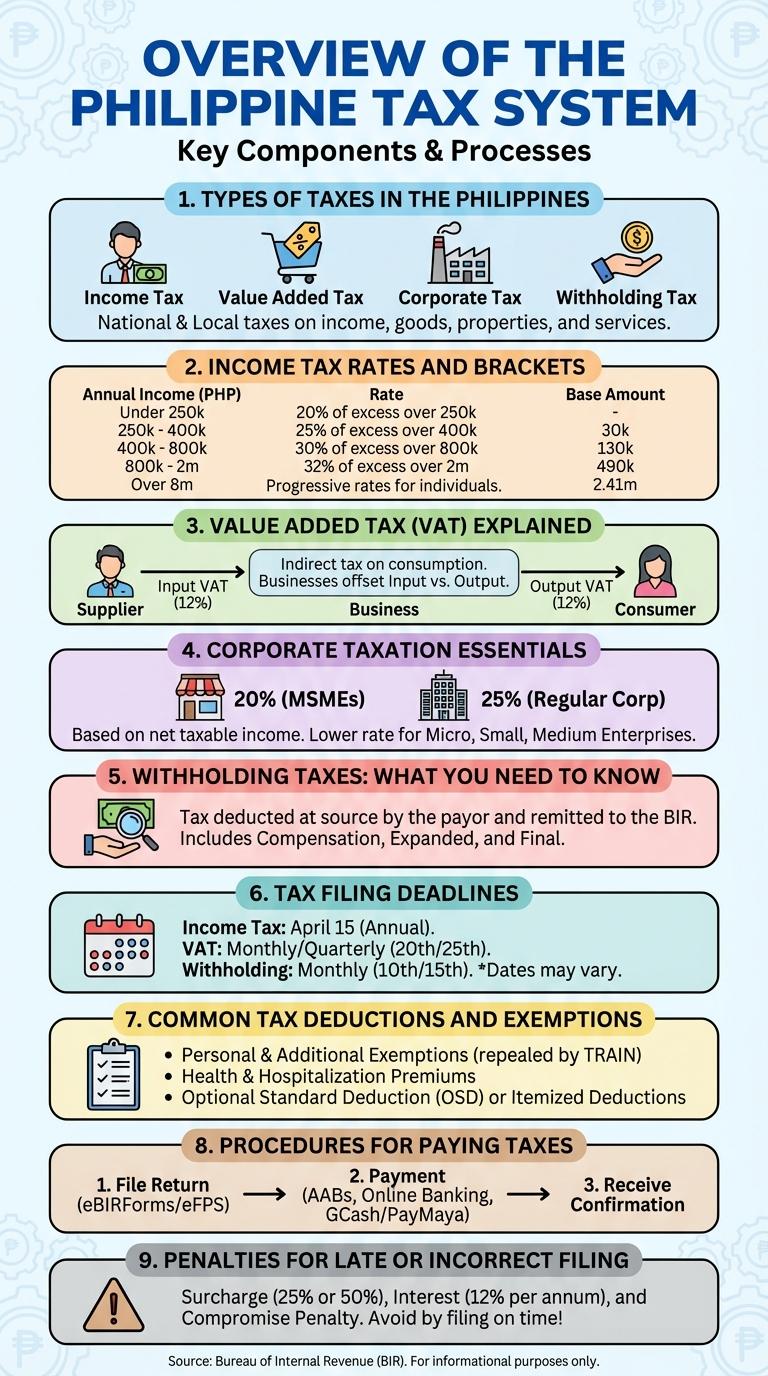

Taxation in the Philippines plays a crucial role in funding public services and infrastructure development. Understanding the country's tax system, including types of taxes such as income tax, value-added tax, and excise tax, helps individuals and businesses comply with legal requirements. This infographic provides a clear overview of key tax concepts, rates, and filing procedures to simplify the complexities of Philippine taxation.

Overview of the Philippine Tax System

The Philippine tax system is designed to generate government revenue through various forms of taxation, including income, value-added, and excise taxes. It is administered primarily by the Bureau of Internal Revenue (BIR) under the Department of Finance.

- Income Tax - Individuals and corporations pay taxes on their income following graduated tax rates and specific exemptions.

- Value-Added Tax (VAT) - A 12% tax is imposed on the sale, exchange, or lease of goods and services in the Philippines.

- Excise Tax - Levied on specific goods such as alcohol, tobacco, and petroleum products to discourage consumption and fund government programs.

Types of Taxes in the Philippines

Taxation in the Philippines is structured to fund government operations and public services. There are several types of taxes that individuals and businesses must pay, categorized mainly into national and local taxes. Understanding these taxes is crucial for compliance and efficient financial planning.

| Type of Tax | Description |

|---|---|

| Income Tax | Levied on the income of individuals and corporations, progressive rates apply based on income brackets. |

| Value-Added Tax (VAT) | A 12% tax imposed on the sale of goods and services, ensuring revenue from business transactions. |

| Excise Tax | Applied to specific goods like alcohol, tobacco, and petroleum products to regulate consumption. |

| Estate Tax | Collected on the transfer of the estate of deceased persons, based on its net value. |

| Local Taxes | Includes real property tax, business tax, and community tax imposed by local government units. |

Income Tax Rates and Brackets

Income tax in the Philippines is imposed on individuals based on progressive tax rates and income brackets. The rates vary from 0% to 35%, affecting different levels of taxable income.

The tax system is governed by the TRAIN Law, which updated brackets to reflect inflation and economic changes.

- 0% Tax Rate for Annual Income up to P250,000 - Individuals earning this amount or less are exempt from income tax.

- 20% Tax Rate on Income over P250,000 to P400,000 - This bracket covers income where tax is computed at 20% of the excess over P250,000.

- 25% Tax Rate on Income over P400,000 to P800,000 - Taxpayers in this range are taxed 25% on the amount exceeding P400,000 plus fixed amounts for lower brackets.

- 30% Tax Rate on Income over P800,000 to P2,000,000 - Applied to higher earners with incremental fixed taxes added.

- 35% Tax Rate on Income above P8,000,000 - The highest tax bracket imposes a 35% rate on income exceeding P8 million, including cumulative fixed taxes.

Value Added Tax (VAT) Explained

Value Added Tax (VAT) in the Philippines is a 12% tax imposed on the sale, barter, exchange, or lease of goods and services within the country. It aims to generate government revenue and is collected at each stage of the supply chain, from manufacturer to consumer. Businesses with annual gross sales exceeding PHP 3,000,000 are required to register and charge VAT on their transactions.

Corporate Taxation Essentials

Corporate taxation in the Philippines requires businesses to comply with the National Internal Revenue Code. The standard corporate income tax rate is 25% as of 2023 for most corporations.

The Minimum Corporate Income Tax (MCIT) is set at 1% of gross income, applicable after three taxable years of operation. Companies must also consider the Value Added Tax (VAT) at 12% on applicable goods and services.

Withholding Taxes: What You Need to Know

Withholding taxes in the Philippines are amounts withheld by employers or payers from income payments and remitted to the Bureau of Internal Revenue (BIR). These taxes ensure proper collection of income tax from salary, professional fees, and other income sources.

Employers withhold taxes based on the employee's income and remit them monthly to the BIR. Various types of withholding taxes include withholding tax on compensation, expanded withholding tax, and final withholding tax. Compliance with withholding tax requirements helps avoid penalties and promotes transparency in tax collection.

Tax Filing Deadlines in the Philippines

What are the key tax filing deadlines in the Philippines? Individual taxpayers must file their annual income tax returns by April 15 each year. Corporations need to submit their tax reports by the 15th day of the fourth month after the fiscal year ends.

When do value-added tax (VAT) filings occur in the Philippines? VAT returns and payments are due monthly, specifically on the 20th day of the month following the taxable period. Quarterly VAT returns must be filed by the 25th day of the month after the quarter ends.

What is the deadline for withholding tax remittance in the Philippines? Employers and withholding agents should remit withheld taxes to the Bureau of Internal Revenue (BIR) by the 10th day of the month following the withholding period. Monthly remittance applies to taxes withheld on compensation and expanded withholding tax.

Are there specific deadlines for estate and donor's tax filings in the Philippines? Estate tax returns must be filed within six months after the decedent's death. Donor's tax returns should be submitted within 30 days from the donor's date of donation.

How does filing deadline compliance impact taxpayers in the Philippines? Timely tax filing avoids penalties and surcharges imposed by the BIR. Meeting deadlines contributes to smoother tax processing and better financial planning for individuals and businesses.

Common Tax Deductions and Exemptions

Taxation in the Philippines includes various deductions and exemptions designed to lower taxable income for individuals and businesses. Understanding common tax benefits helps taxpayers optimize their tax liabilities legally.

- Personal Exemptions - Fixed amounts deducted from income for the taxpayer and dependents to reduce taxable income.

- Additional Exemptions - Extra deductions allowed for senior citizens and persons with disabilities to ease their tax burden.

- Mandatory Contributions - Deductions for SSS, PhilHealth, and Pag-IBIG Fund contributions are exempt from income tax.

- Health and Housing Benefits - Certain health insurance benefits and housing loan interests are deductible to encourage welfare and investment.

- Business Expense Deductions - Legitimate expenses such as rent, utilities, and salaries are deductible for self-employed individuals and corporations.

Maximizing these tax deductions and exemptions ensures compliance while effectively reducing tax payments in the Philippines.

Procedures for Paying Taxes

| Step | Procedure |

|---|---|

| 1. Register with BIR | Obtain a Taxpayer Identification Number (TIN) by registering through the Bureau of Internal Revenue (BIR) online or at the local Revenue District Office. |

| 2. Determine Tax Type | Identify applicable taxes such as income tax, value-added tax (VAT), or withholding tax based on your income or business activity. |

| 3. File Tax Returns | Submit the required tax forms electronically via eFPS or manually at authorized BIR offices within the prescribed deadlines. |

| 4. Calculate Tax Amount | Compute tax due according to official BIR schedules, rates, and allowable deductions or exemptions. |

| 5. Pay Taxes | Make payments through accredited banks, online payment systems, or authorized agent banks for convenience and compliance. |