Saving money builds financial security by creating a safety net for unexpected expenses and future goals. It empowers individuals to reduce debt, increase investments, and achieve financial independence. Consistent saving promotes disciplined spending habits and long-term wealth growth.

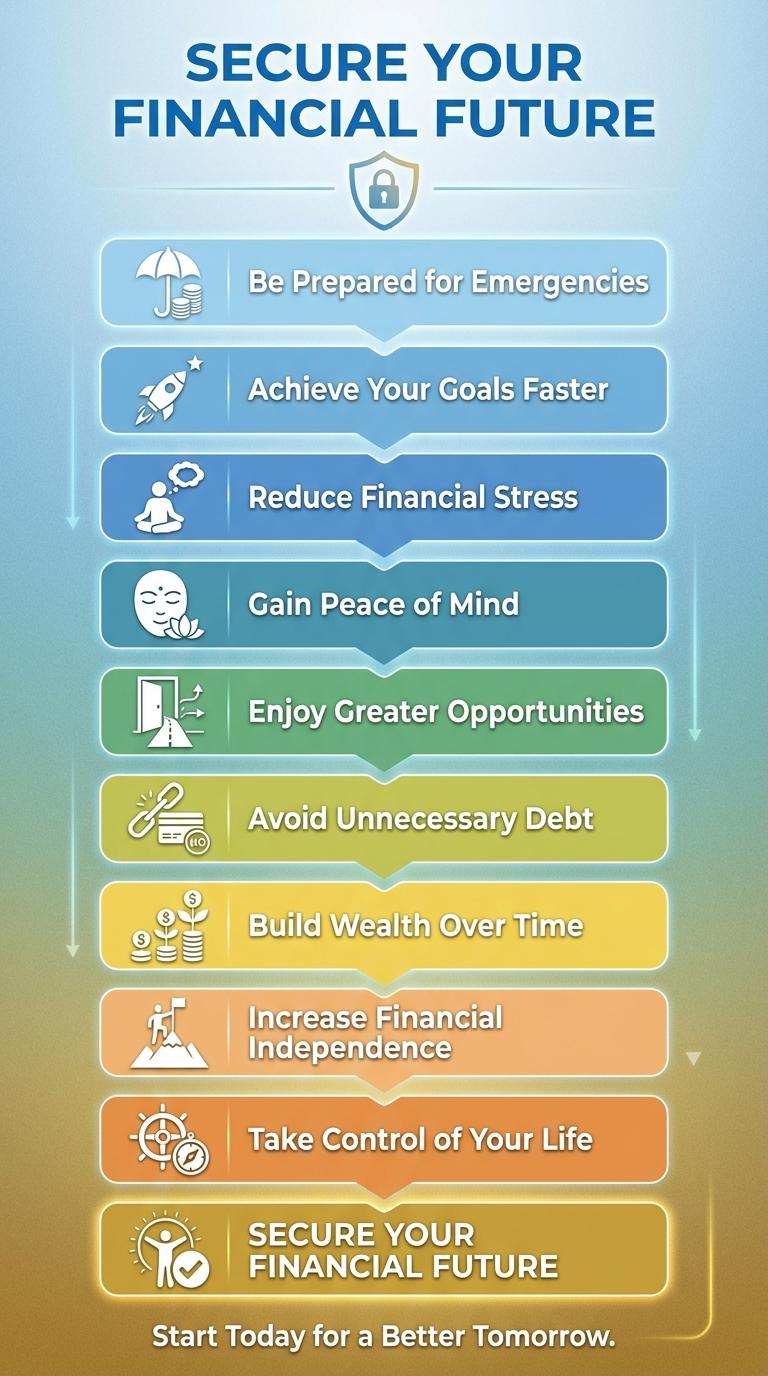

Secure Your Financial Future

Saving money is essential for building a stable financial foundation and achieving long-term goals. It provides a safety net that protects against unexpected expenses and uncertainties.

- Emergency Fund - Having savings ensures you can cover unforeseen costs like medical bills or car repairs without debt.

- Retirement Security - Consistent saving helps accumulate wealth to support a comfortable retirement lifestyle.

- Financial Independence - Savings allow you to make important life decisions without relying on loans or credit.

Be Prepared for Emergencies

Saving money builds a financial safety net for unexpected expenses such as medical emergencies, car repairs, or job loss. Having funds readily available reduces stress and provides peace of mind during unforeseen events.

Emergency savings prevent reliance on high-interest loans or credit cards, protecting your credit score and financial health. A dedicated savings fund ensures you can cover urgent costs without disrupting your daily budget. Prioritizing emergency savings empowers you to handle crises confidently and maintain financial stability.

Achieve Your Goals Faster

Saving money accelerates the achievement of your financial goals by providing the necessary funds without delay. Consistent saving builds a financial cushion that enables quick investments or purchases. This strategic approach reduces reliance on credit and interest, making your goals more attainable in less time.

Reduce Financial Stress

How does saving money help reduce financial stress? Saving money creates a safety net that provides peace of mind during unexpected expenses. It minimizes worry by ensuring funds are available for emergencies.

Gain Peace of Mind

Saving money provides a solid foundation for financial security and reduces stress caused by unexpected expenses. Building savings creates a safety net that promotes peace of mind and confidence in your financial future.

- Emergency Fund - Having money set aside for emergencies prevents panic during financial crises and unexpected costs.

- Financial Stability - Consistent savings improve your ability to handle monthly bills and reduce worry about income fluctuations.

- Reduced Debt Anxiety - Savings minimize dependence on credit, lowering anxiety associated with debt repayment pressures.

Enjoy Greater Opportunities

| Benefit | Explanation |

|---|---|

| Travel Opportunities | Saving money enables you to explore new destinations, broadening your horizons and creating unforgettable experiences. |

| Educational Advancement | Funds accumulated through saving can be invested in courses, certifications, or degrees, enhancing career prospects and knowledge. |

| Entrepreneurial Ventures | Having savings allows you to launch or support your own business, turning ideas into profitable opportunities. |

| Housing Options | Money saved can contribute to a down payment on a home, offering stability and investment growth over time. |

| Emergency Flexibility | A solid savings cushion provides freedom to handle unforeseen expenses without stress or compromising plans. |

Avoid Unnecessary Debt

Saving money is a crucial step in maintaining financial health and stability. It helps individuals steer clear of avoidable debt and fosters long-term security.

- Reduces Reliance on Credit Cards - By having savings, people can cover unexpected expenses without resorting to high-interest credit cards.

- Prevents Accumulation of Interest - Avoiding debt means less money spent on costly interest payments over time.

- Builds Emergency Fund - Savings create a financial cushion to manage emergencies without needing loans or borrowing.

Consistent saving habits empower financial independence and reduce stress linked to debt.

Build Wealth Over Time

Saving money consistently helps build wealth over time by allowing your funds to grow through compound interest and smart investments. Small, regular contributions can accumulate into a significant financial cushion.

By saving, you gain financial security and the ability to seize future opportunities without debt. This disciplined habit lays the foundation for long-term prosperity and independence.

Increase Financial Independence

Saving money empowers individuals to achieve greater financial independence by providing a stable financial foundation. Building a habit of saving creates a safety net that reduces reliance on external financial support.

Increased financial independence enhances decision-making freedom and reduces stress during emergencies or unexpected expenses. Consistent savings contribute to long-term wealth accumulation and personal security.