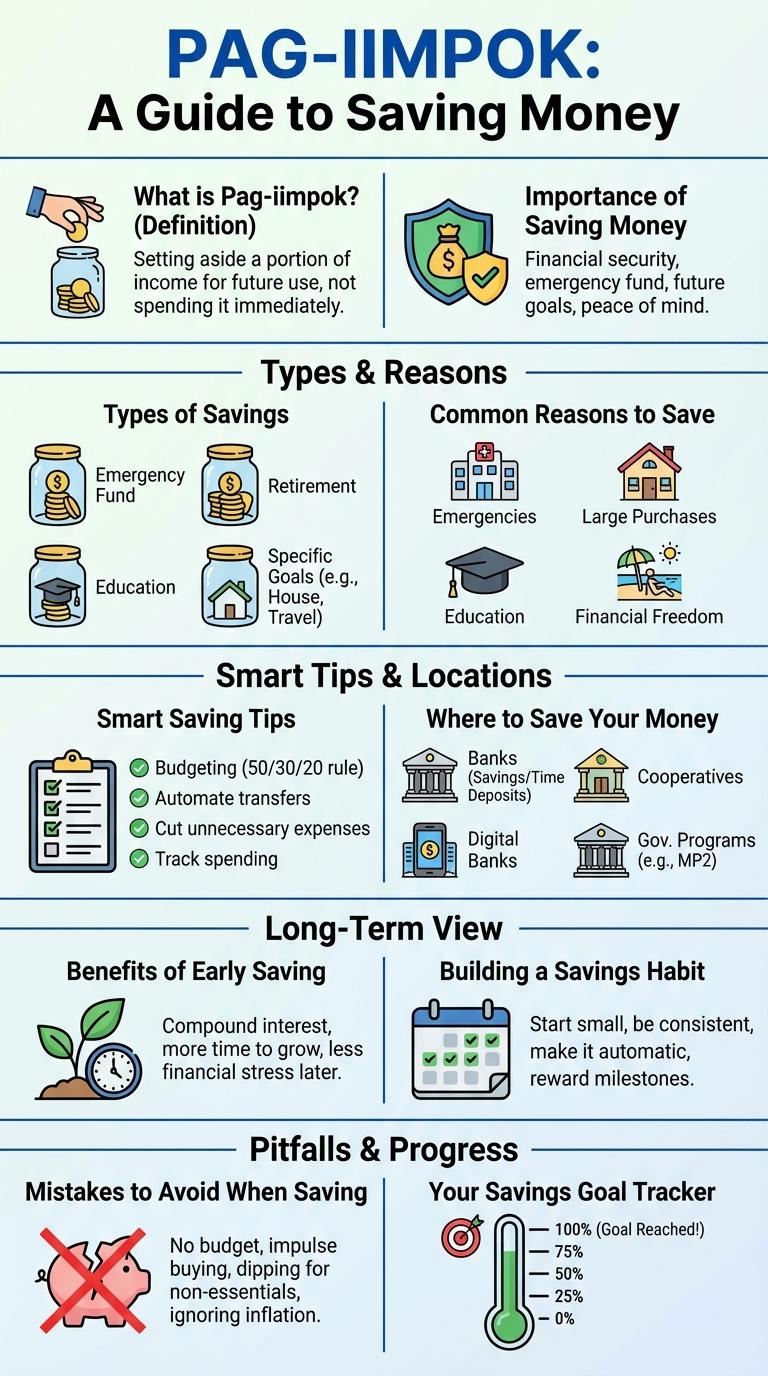

Pag-iimpok plays a crucial role in achieving financial stability by encouraging disciplined saving habits. Infographics visually simplify key concepts of budgeting, saving strategies, and the benefits of consistent money management. Understanding these elements helps individuals build a secure financial future and avoid unnecessary debt.

What is Pag-iimpok?

Pag-iimpok is the Filipino term for saving money or setting aside funds for future use. It involves intentionally putting aside a portion of income to achieve financial goals and ensure financial security.

Pag-iimpok helps individuals build emergency funds, plan for big expenses, and create a safety net during uncertain times. It fosters financial discipline and promotes long-term stability. Regular pag-iimpok encourages smart money management and reduces financial stress.

Importance of Saving Money

Why is saving money essential for financial security?

Saving money builds a financial safety net that helps cover unexpected expenses. It also enables long-term goals, like buying a house or retirement planning.

Types of Savings

Pag-iimpok involves setting aside money for future use, promoting financial security and goal achievement. Common types of savings include emergency funds, retirement savings, and education funds. Each savings type serves a distinct purpose, helping individuals manage unexpected expenses, plan for long-term needs, or finance education.

Common Reasons to Save

Saving money is essential for financial security and achieving long-term goals. Understanding the common reasons for saving helps prioritize your financial planning.

- Emergency Fund - Provides a financial cushion for unexpected expenses such as medical bills or urgent repairs.

- Education Expenses - Helps cover tuition fees and other educational costs for yourself or your family.

- Home Purchase - Accumulates funds needed for down payments or home renovations.

- Retirement - Ensures a steady income and comfortable lifestyle after retirement.

- Travel and Leisure - Allows you to enjoy vacations and hobbies without financial stress.

Identifying your saving goals makes it easier to stay motivated and manage your budget effectively.

Smart Saving Tips

Saving money effectively requires smart strategies that align with your financial goals. Implementing simple habits can lead to significant savings over time.

- Create a Budget - Track income and expenses to identify areas where you can cut costs and save more.

- Automate Savings - Set up automatic transfers to your savings account to ensure consistent saving without effort.

- Prioritize Emergency Fund - Build a reserve to cover unexpected expenses and avoid debt during financial setbacks.

Where to Save Your Money

Choosing the right place to save your money is essential for financial growth and security. Consider options like savings accounts, time deposits, and investment funds, each offering different benefits and interest rates. Evaluate the interest rates, accessibility, and risk levels to find the best fit for your savings goals.

Benefits of Early Saving

Saving money early helps build a strong financial foundation for the future. It encourages disciplined spending habits and financial security.

Starting to save at a young age maximizes the power of compound interest. Early saving sets the stage for achieving long-term financial goals.

- Compound Interest Growth - Money saved early earns interest on both the initial amount and accumulated interest, increasing total savings.

- Financial Discipline - Early saving promotes consistent saving habits and better money management skills.

- Emergency Preparedness - Having savings ensures quick access to funds during unexpected expenses or emergencies.

- Goal Achievement - Early saving enables easier accumulation of funds needed for education, housing, or retirement.

- Reduced Financial Stress - A growing savings account provides peace of mind and reduces anxiety about future expenses.

Building a Savings Habit

| Step | Description |

|---|---|

| Start Small | Begin with a manageable amount to avoid feeling overwhelmed and build consistency. |

| Set Clear Goals | Define specific savings targets to stay motivated and measure progress effectively. |

| Create a Budget | Track income and expenses to allocate funds for savings regularly without financial strain. |

| Automate Savings | Use automatic transfers to move money into savings accounts, ensuring timely deposits. |

| Review and Adjust | Regularly evaluate savings habits and modify strategies to improve and reach goals faster. |

Mistakes to Avoid When Saving

Saving money is essential for financial security, but common mistakes can hinder your progress. Avoiding these errors helps you build a stronger financial foundation effectively.

Ignoring a budget leads to uncontrolled spending, reducing the amount you can save each month. Over-reliance on high-interest loans undermines your savings and increases debt burden.