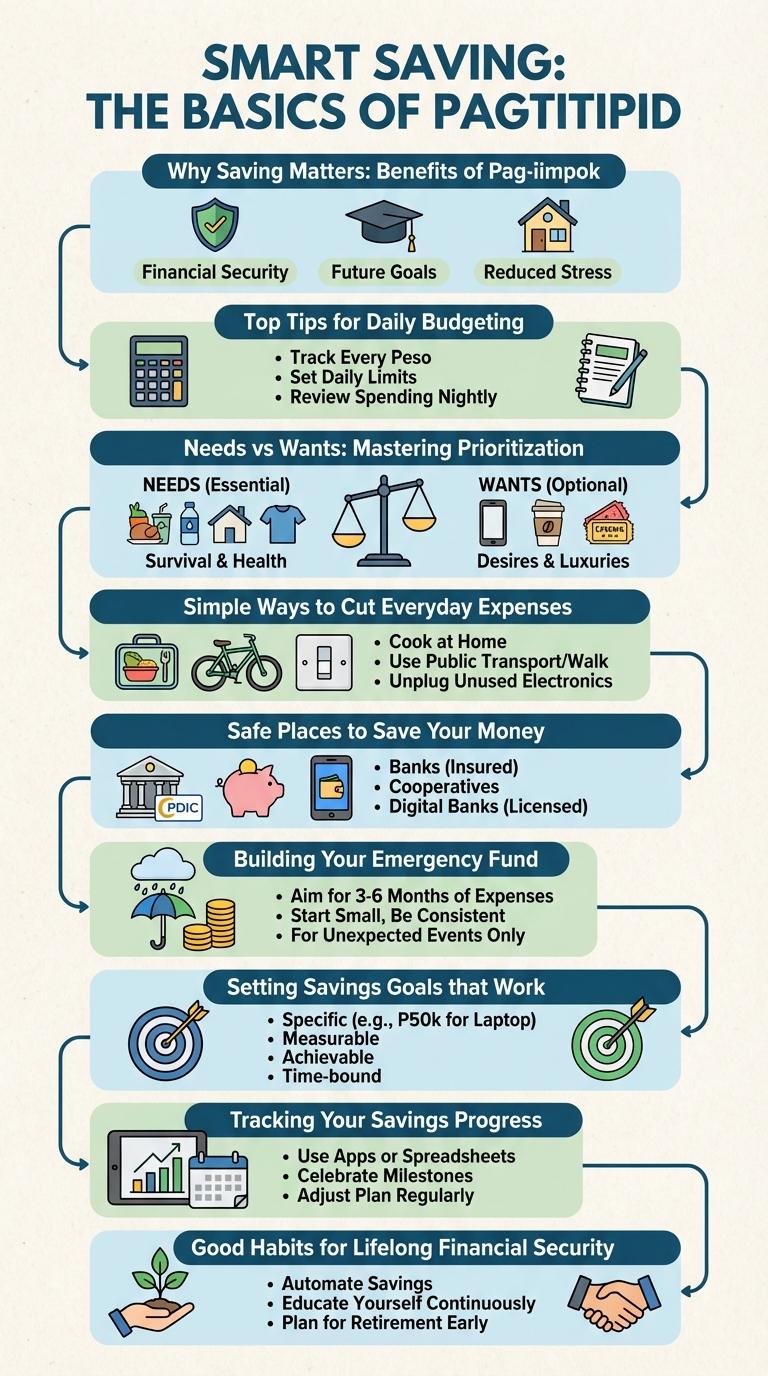

Pagtitipid at pag-iimpok ay mahalagang hakbang upang mapanatili ang matatag na kalagayan ng pananalapi. Ang infographic na ito ay naglalaman ng mga praktikal na tips at estratehiya para sa epektibong pag-budget, pag-iwas sa labis na gastusin, at maayos na pagpaplano ng kinabukasan. Sa pamamagitan ng wastong paghawak ng pera, makakamit ang mga pangmatagalang layunin at financial security.

Smart Saving: The Basics of Pagtitipid

What is the importance of smart saving in daily life? Smart saving helps build financial security and prepares you for future needs. It encourages disciplined spending and prioritizing essential expenses over impulsive buying.

How can one start practicing pagtitipid effectively? Begin by tracking your income and expenses to identify areas for reduction. Setting clear savings goals and creating a budget aids in maintaining consistent financial habits.

Why is setting a budget crucial for pag-iimpok? A budget provides a clear plan for managing money, ensuring that savings goals are met without sacrificing necessities. It helps avoid debt and promotes responsible financial behavior.

What role does emergency fund play in smart saving? An emergency fund covers unexpected expenses without disrupting regular savings or incurring debt. It is a key component for financial stability and peace of mind.

How does avoiding unnecessary expenses maximize your savings? Cutting down on non-essential purchases increases the amount of money available to save and invest. Prioritizing needs over wants leads to more effective pag-iimpok and long-term wealth growth.

Why Saving Matters: Benefits of Pag-iimpok

Pag-iimpok builds financial security by providing a safety net during emergencies and unexpected expenses. It enables the achievement of long-term goals such as education, home ownership, and retirement. Consistent saving cultivates discipline and promotes better money management habits, leading to overall financial well-being.

Top Tips for Daily Budgeting

Effective daily budgeting is essential for successful pagtitipid at pag-iimpok (saving and economizing). Prioritizing expenses and tracking daily spending helps maintain financial discipline.

Start by listing fixed and variable costs to identify potential savings. Allocate a specific amount for daily needs and avoid unnecessary purchases to maximize savings.

Needs vs Wants: Mastering Prioritization

| Needs | Wants |

|---|---|

| Essential for survival and daily living | Non-essential items or services desired for comfort or pleasure |

| Examples: food, shelter, clothing, healthcare | Examples: gadgets, branded clothes, dining out, entertainment |

| Priority in budgeting and savings plans | Considered only after needs are fully met |

| Helps achieve financial stability | Can lead to impulsive spending and depleted savings |

| Supports long-term money management and emergency funds | Focus on wants may delay savings goals and increase debt risk |

Simple Ways to Cut Everyday Expenses

Cutting everyday expenses and saving money can significantly improve your financial health. Simple lifestyle adjustments help you manage your budget more effectively and build your savings over time.

Track your daily spending to identify unnecessary expenses. Use affordable alternatives like cooking at home instead of eating out. Prioritize needs over wants to avoid impulse purchases and increase your savings steadily.

Safe Places to Save Your Money

Choosing safe places to save your money ensures financial security and peace of mind. Reliable options protect funds from loss and allow for steady growth over time.

Bank savings accounts offer insured deposits and easy accessibility. Government bonds provide a low-risk investment backed by national entities.

Building Your Emergency Fund

Building your emergency fund is essential for financial security during unexpected events. It helps cover urgent expenses without relying on credit or loans.

- Set a Target Amount - Aim to save at least three to six months' worth of living expenses for full financial protection.

- Start Small and Consistently - Regularly set aside a fixed amount to gradually build a substantial emergency fund over time.

- Keep Funds Accessible - Store your savings in a high-yield savings account for easy access and minimal risk.

Setting Savings Goals that Work

Setting effective savings goals is essential for successful financial management. Clear objectives guide your saving habits and help build financial security.

- Define Specific Targets - Identify exact amounts and deadlines to make your savings goals measurable and achievable.

- Prioritize Your Goals - Order your savings objectives based on urgency and importance to focus your efforts efficiently.

- Create a Realistic Plan - Develop a budget and monthly saving schedule aligned with your income and expenses to maintain consistency.

Tracking Your Savings Progress

Tracking your savings progress helps you stay motivated and reach your financial goals faster. Use tools like savings apps or journals to record your deposits and monitor growth over time. Regularly reviewing your progress enables adjustments to your budget and saving strategies for optimal results.