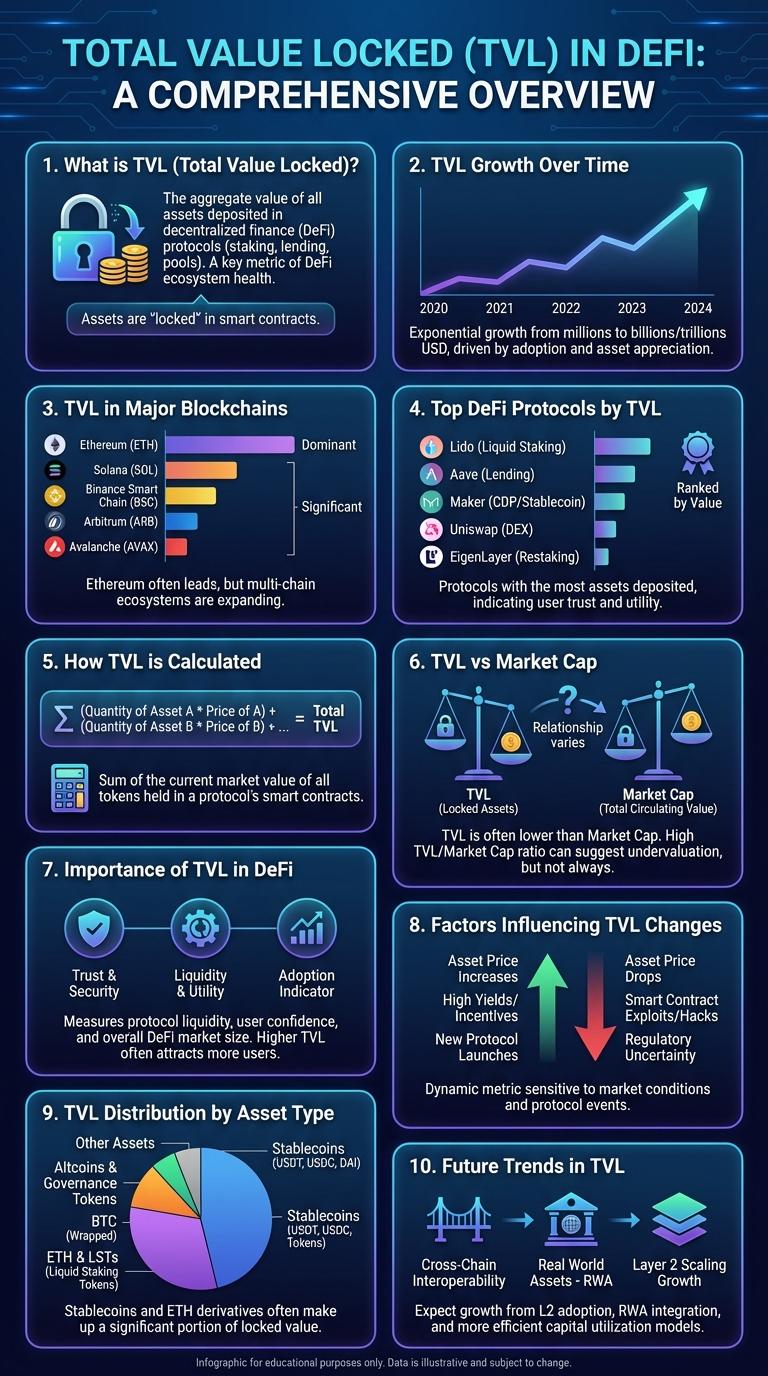

Total Value Locked (TVL) represents the aggregate value of assets staked or locked within decentralized finance (DeFi) platforms, providing a clear indicator of market growth and liquidity. This infographic visualizes the latest TVL trends, highlighting key protocols and their respective asset allocations across various blockchain networks. Understanding TVL dynamics helps investors gauge platform stability and the overall health of the DeFi ecosystem.

What is TVL (Total Value Locked)?

Total Value Locked (TVL) represents the total amount of cryptocurrency assets deposited in decentralized finance (DeFi) protocols. It is a key indicator used to gauge the popularity, growth, and trustworthiness of a DeFi platform. High TVL values reflect strong user confidence and active participation in the ecosystem.

TVL Growth Over Time

| Year | Total Value Locked (TVL) in USD |

|---|---|

| 2018 | $500 million |

| 2019 | $1.2 billion |

| 2020 | $10 billion |

| 2021 | $80 billion |

| 2022 | $150 billion |

TVL in Major Blockchains

Total Value Locked (TVL) represents the aggregated value of assets staked or locked in decentralized finance (DeFi) protocols across various blockchains. It serves as a key metric to assess the health and growth of DeFi ecosystems.

Ethereum maintains the highest TVL, driven by its mature DeFi infrastructure and widespread adoption. Binance Smart Chain follows closely, favored for its low fees and fast transactions, attracting a broad user base. Other blockchains like Solana, Terra, and Avalanche showcase rapidly growing TVLs due to innovative protocols and scalability advantages.

Top DeFi Protocols by TVL

Total Value Locked (TVL) represents the overall capital deposited in DeFi protocols, indicating the health and growth of decentralized finance platforms. It measures the aggregated value of assets staked or locked in smart contracts across various DeFi applications.

The top DeFi protocols by TVL include leading platforms such as MakerDAO, Aave, Uniswap, Compound, and Curve Finance. These protocols offer lending, borrowing, and decentralized exchange services, driving significant liquidity and user engagement in the DeFi ecosystem.

How TVL is Calculated

What is Total Value Locked (TVL) in decentralized finance?

Total Value Locked represents the total capital held within a DeFi protocol's smart contracts. It indicates the overall liquidity and user trust in the platform.

How is TVL typically calculated?

TVL is calculated by summing the value of all assets deposited inside a DeFi protocol. The calculation uses current market prices to reflect accurate asset valuations.

Which assets are included in the TVL calculation?

All cryptocurrencies, tokens, and liquidity provider tokens locked in the protocol are included. This provides a comprehensive measure of locked funds.

How do price fluctuations affect TVL?

Price changes in underlying assets directly impact TVL values. An increase in asset prices raises TVL, while price drops lower the overall locked value.

Why is TVL important for DeFi platforms?

TVL shows the protocol's liquidity health and market confidence. Higher TVL often correlates with greater security and user adoption.

TVL vs Market Cap

TVL (Total Value Locked) and Market Cap are key indicators in the cryptocurrency and DeFi sectors, reflecting the ecosystem's health and value. Understanding the relationship between TVL and Market Cap helps investors gauge project potential and market dynamics.

- TVL measures locked assets - TVL quantifies the total assets staked or locked within DeFi protocols, indicating user confidence and liquidity availability.

- Market Cap values overall project worth - Market Cap calculates the total value of a cryptocurrency's circulating supply multiplied by its current price, reflecting investor sentiment and market size.

- TVL vs Market Cap ratio reveals valuation - A low TVL-to-Market Cap ratio may signal an overvalued asset, whereas a high ratio indicates strong liquidity backing relative to market price.

Importance of TVL in DeFi

Total Value Locked (TVL) measures the total assets staked in DeFi protocols, reflecting the platform's liquidity and user trust. High TVL indicates strong user participation and robust security within decentralized finance ecosystems.

TVL serves as a key metric for evaluating the growth and stability of DeFi projects, influencing investor confidence and market dynamics. Monitoring TVL helps identify trends, assess protocol performance, and compare competitors effectively.

Factors Influencing TVL Changes

Total Value Locked (TVL) is a key metric that measures the amount of assets staked or deposited in decentralized finance (DeFi) protocols. Understanding the factors influencing TVL helps in analyzing market trends and protocol growth.

- Market Sentiment - Positive investor confidence often drives asset inflows, increasing TVL.

- Protocol Upgrades - New features or security improvements can attract more users, raising TVL.

- Liquidity Incentives - Higher rewards or yields encourage larger deposits, boosting TVL.

Tracking these factors provides valuable insights into the health and future potential of DeFi platforms.

TVL Distribution by Asset Type

Total Value Locked (TVL) represents the aggregate value of assets committed within decentralized finance (DeFi) protocols.

TVL Distribution by Asset Type categorizes the locked assets into cryptocurrencies, stablecoins, and tokenized assets, highlighting their relative proportions.

This breakdown offers insights into market preferences, liquidity trends, and risk exposure across various asset classes in DeFi ecosystems.