Accounting infographics present complex financial data in a clear and visually engaging format, enhancing comprehension and retention. They highlight key accounting principles, important metrics, and standard practices, making information accessible for both professionals and novices. By combining visuals with concise data, these infographics streamline the learning process and support effective decision-making.

The Basics of Accounting

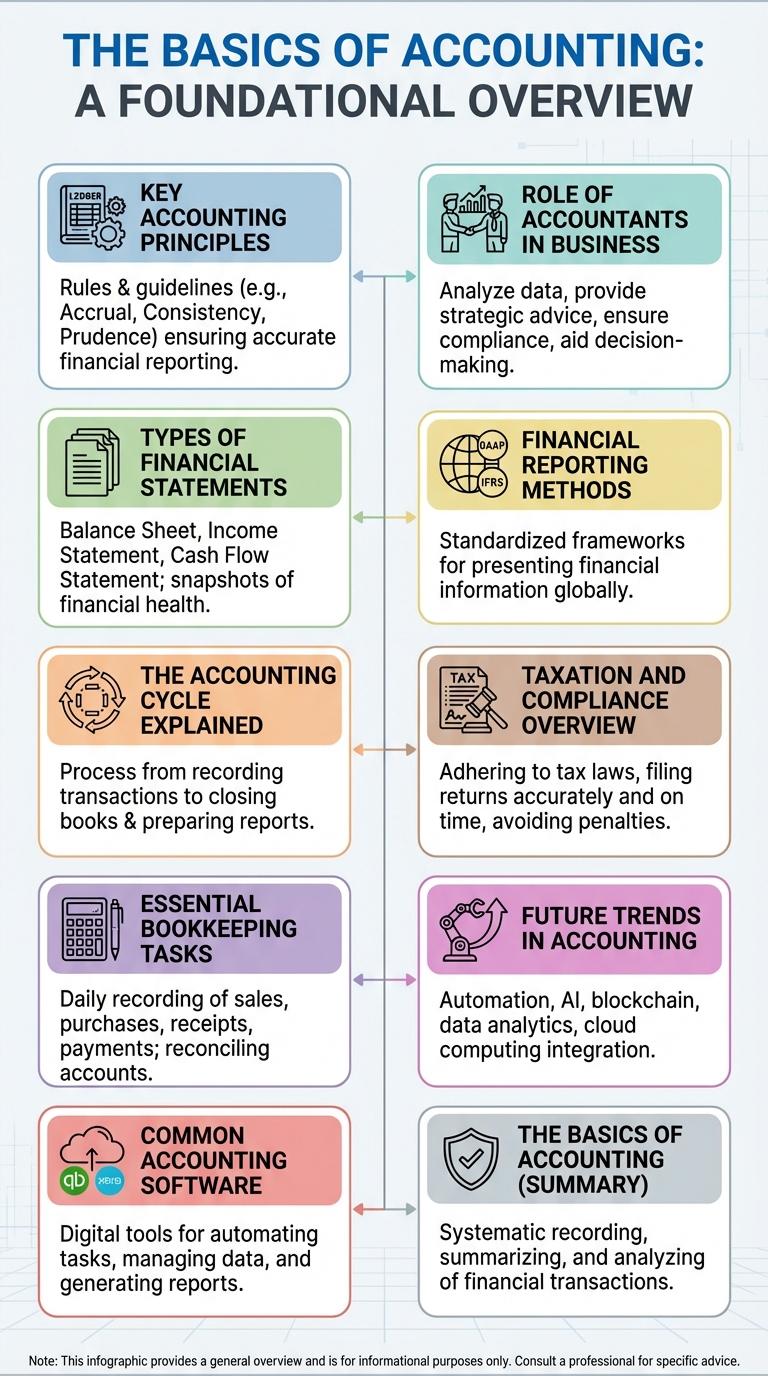

Accounting is the systematic process of recording, summarizing, and analyzing financial transactions. It provides essential information for decision-making, ensuring accuracy and transparency in business finances.

The basics of accounting include understanding assets, liabilities, equity, revenues, and expenses. These elements form the foundation of financial statements like the balance sheet and income statement.

Key Accounting Principles

Accounting is guided by fundamental principles that ensure accurate financial reporting. These key accounting principles provide a framework for consistent and reliable financial statements.

- Accrual Principle - Revenues and expenses are recorded when they are earned or incurred, not when cash is exchanged.

- Consistency Principle - The same accounting methods must be applied from period to period to maintain comparability.

- Going Concern Principle - Financial statements are prepared assuming the business will continue operating indefinitely.

Types of Financial Statements

Financial statements are essential documents that provide a clear picture of a company's financial health. They assist stakeholders in making informed business decisions by summarizing financial data.

- Balance Sheet - Shows a company's assets, liabilities, and equity at a specific point in time, reflecting its financial position.

- Income Statement - Reports revenues and expenses over a period, illustrating profitability and operational performance.

- Cash Flow Statement - Tracks inflows and outflows of cash, highlighting liquidity and cash management.

The Accounting Cycle Explained

The accounting cycle is a systematic process used by businesses to record and manage financial transactions. It ensures accuracy and consistency in financial reporting throughout an accounting period.

This cycle begins with identifying transactions and ends with preparing financial statements. Key steps include journalizing, posting to the ledger, trial balance preparation, adjusting entries, and closing the books. The accounting cycle repeats each period to maintain organized financial records and support decision-making.

Essential Bookkeeping Tasks

| Essential Bookkeeping Task | Description |

|---|---|

| Recording Transactions | Systematic entry of all financial transactions including sales, purchases, receipts, and payments. |

| Reconciling Bank Statements | Matching company records with bank statements to ensure accuracy and detect discrepancies. |

| Managing Invoices | Issuing and tracking customer invoices for timely payment and recording incoming supplier invoices for expenses. |

| Payroll Processing | Calculating employee wages, tax deductions, and managing payment schedules according to regulations. |

| Maintaining General Ledger | Organizing and maintaining the master record of all financial transactions to prepare financial statements. |

Common Accounting Software

Accounting software streamlines financial management for businesses of all sizes. It automates bookkeeping, invoicing, and reporting tasks to enhance accuracy and efficiency.

- QuickBooks - Popular among small businesses for its easy-to-use interface and comprehensive features.

- FreshBooks - Designed for freelancers and service providers, focusing on invoicing and time tracking.

- Xero - Cloud-based software offering real-time financial data and integration with multiple apps.

Choosing the right accounting software depends on business needs, scalability, and budget considerations.

Role of Accountants in Business

What is the role of accountants in business?

Accountants manage financial records, ensuring accuracy and compliance with regulations. They provide critical insights that help businesses make informed financial decisions.

Financial Reporting Methods

Financial reporting methods are essential tools used to present the financial performance and position of a business. These methods ensure transparency and consistency in conveying financial information to stakeholders.

Common financial reporting methods include cash basis accounting and accrual basis accounting. Each method affects how revenue and expenses are recorded, influencing the overall financial statements.

Taxation and Compliance Overview

Taxation and compliance are critical components of effective accounting, ensuring businesses meet legal requirements and avoid penalties. Proper tax planning and reporting help optimize financial performance while adhering to regulatory frameworks. Understanding key compliance standards, such as VAT, corporate tax, and payroll regulations, is essential for accurate financial management.