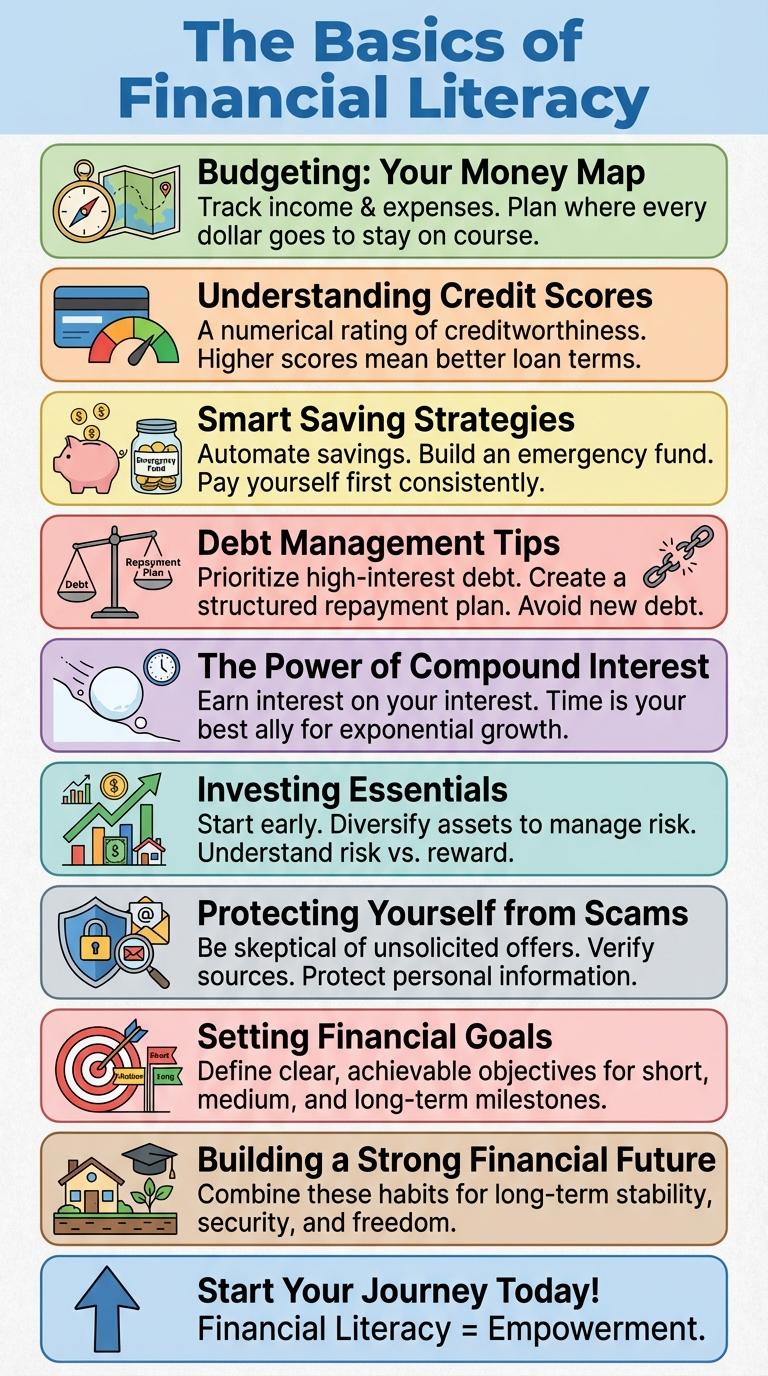

Understanding financial literacy empowers individuals to make informed decisions about budgeting, saving, investing, and managing debt. Visual representations in an infographic simplify complex financial concepts, making them accessible to diverse audiences. This resource highlights key principles and practical tips that promote financial well-being and long-term stability.

The Basics of Financial Literacy

Financial literacy is the ability to understand and manage personal finances effectively. It involves skills like budgeting, saving, investing, and managing debt.

Mastering these basics helps individuals make informed decisions to secure their financial future. Key components include understanding interest rates, credit scores, and the importance of emergency funds.

Budgeting: Your Money Map

Budgeting is the cornerstone of financial literacy, acting as your personal money map. It helps you track income and expenses to achieve your financial goals effectively.

Creating a budget starts with listing your sources of income and categorizing your expenses into needs and wants. Allocate funds wisely to cover essentials first, then save and invest the remainder. Regularly reviewing and adjusting your budget ensures you stay on track and avoid unnecessary debt.

Understanding Credit Scores

Understanding credit scores is essential for managing personal finances effectively. Credit scores range from 300 to 850, reflecting an individual's creditworthiness based on factors like payment history and debt levels. Higher credit scores improve loan approval chances and secure better interest rates.

Smart Saving Strategies

How can smart saving strategies improve your financial future? Building strong saving habits protects you from unexpected expenses and helps achieve long-term goals. Prioritizing automated savings and budgeting effectively boosts your overall financial health.

What are the best saving methods to maximize your money? Using high-yield savings accounts increases interest earnings while minimizing risks. Implementing the 50/30/20 budgeting rule allocates funds wisely for needs, wants, and savings.

Why is setting clear financial goals essential for saving? Clear goals create motivation and guide your saving amounts. Visualizing targets like buying a home or funding education improves discipline and tracking progress.

How does reducing unnecessary expenses contribute to smart saving? Cutting non-essential spending frees up money for important priorities. Regularly reviewing subscriptions and daily habits uncovers opportunities to boost savings effortlessly.

What role does financial education play in smart saving? Understanding concepts like compound interest and inflation empowers better decisions. Continuous learning enhances confidence in managing and growing your savings effectively.

Debt Management Tips

Understanding debt management is crucial for maintaining financial stability and reducing stress. Effective strategies help individuals control their debts and build a solid financial future.

- Create a Budget - Track income and expenses to allocate funds efficiently towards debt repayment.

- Prioritize High-Interest Debt - Focus on paying off debts with the highest interest rates first to minimize overall costs.

- Negotiate with Creditors - Communicate with lenders to explore lower interest rates or payment plans.

The Power of Compound Interest

Compound interest is the process where the interest earned on an investment is reinvested to generate additional earnings over time. This creates a snowball effect, allowing wealth to grow exponentially rather than linearly.

Even small initial investments can multiply significantly with consistent contributions and time. Understanding compound interest is key to making informed financial decisions and achieving long-term financial goals.

Investing Essentials

Investing is a critical component of building long-term wealth and achieving financial goals. Understanding the essentials helps individuals make informed decisions and manage risks effectively.

- Asset Diversification - Spreading investments across different asset classes reduces risk and enhances potential returns.

- Compound Interest - Reinvesting earnings generates exponential growth over time, maximizing investment value.

- Risk Tolerance - Knowing your comfort level with risk guides the selection of appropriate investment strategies.

Protecting Yourself from Scams

| Tip | Description |

|---|---|

| Verify Sources | Always confirm the identity of individuals or organizations before sharing personal or financial information. |

| Use Strong Passwords | Create complex passwords using a mix of letters, numbers, and symbols to protect online accounts. |

| Beware of Unsolicited Offers | Ignore unexpected messages or calls requesting money or sensitive details, especially if urgent or threatening. |

| Monitor Financial Statements | Regularly check bank and credit card statements for unfamiliar transactions to detect fraud early. |

| Educate Yourself | Stay informed about common scam techniques and warning signs through trusted financial literacy resources. |

Setting Financial Goals

Setting clear financial goals is essential for effective money management and long-term financial success. Defining priorities helps create actionable plans to achieve desired outcomes.

- Specificity - Clearly define what you want to achieve financially, such as saving for a home or paying off debt.

- Measurability - Establish quantifiable targets to track progress and stay motivated.

- Time-bound - Set deadlines to provide urgency and structure to your financial plans.

Regularly reviewing and adjusting financial goals ensures continued relevance and successful achievement.