Simple interest calculates the cost of borrowing or the earnings on an investment based on the original principal over a set period. This method uses a straightforward formula that multiplies the principal amount, interest rate, and time to determine the total interest. Understanding simple interest is essential for managing loans, savings, and financial planning effectively.

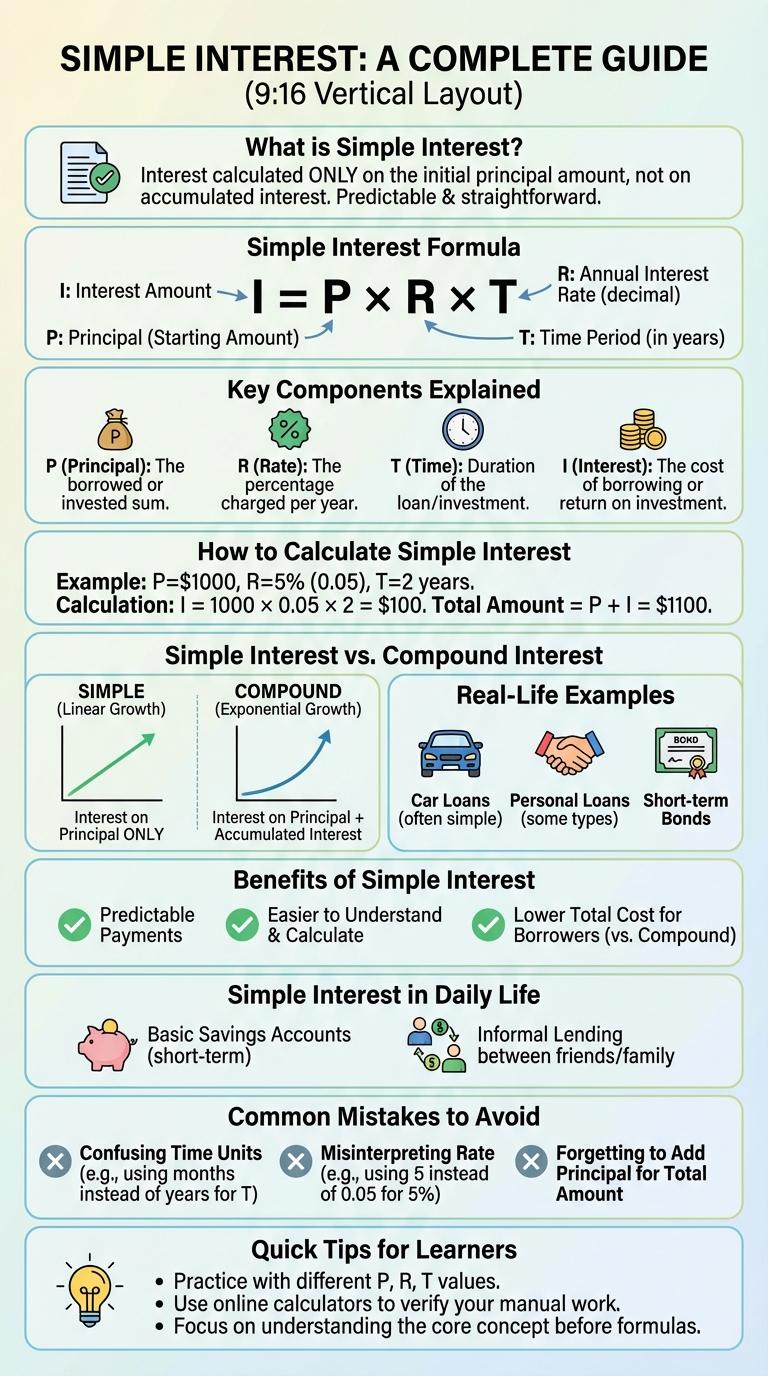

What is Simple Interest?

Simple interest is a method of calculating the interest charge on a loan or investment based on the original principal amount. The formula for simple interest is I = P x R x T, where I is the interest, P is the principal, R is the annual interest rate, and T is the time in years. This type of interest does not compound, meaning interest is only earned on the initial principal throughout the investment period.

Simple Interest Formula

What is the simple interest formula? Simple interest calculates the interest earned or paid on a principal amount over a specific period at a fixed interest rate. The formula is expressed as I = P x R x T, where I represents the interest, P is the principal, R is the rate of interest per year, and T is the time in years.

Key Components Explained

Simple interest is a straightforward method to calculate the cost of borrowing or the return on investment based on the original principal. Understanding its key components helps in accurate financial planning and decision-making.

- Principal - The initial amount of money invested or loaned on which the interest is calculated.

- Interest Rate - The percentage charged or earned on the principal over a specific period.

- Time Period - The duration for which the interest is calculated, often measured in years.

How to Calculate Simple Interest

Simple interest is a quick method to calculate the interest earned or paid on a principal amount over time. It uses a straightforward formula based on the principal, rate, and time.

- Identify the Principal - The principal is the initial amount of money invested or borrowed.

- Determine the Interest Rate - Use the annual interest rate expressed as a decimal or percentage.

- Use the Simple Interest Formula - Calculate interest with the formula: Interest = Principal x Rate x Time.

Simple Interest vs. Compound Interest

Simple interest is calculated only on the principal amount, making it straightforward to understand and compute. Compound interest earns interest on both the principal and accumulated interest, resulting in faster growth over time. Comparing both, simple interest benefits short-term loans, while compound interest suits long-term investments for maximizing returns.

Real-Life Examples

Simple interest is a straightforward method to calculate interest earned or paid on a principal amount over time. It is widely used in everyday financial situations.

- Car Loan Payments - Borrowers often pay simple interest on auto loans calculated on the principal amount throughout the loan term.

- Savings Accounts - Some savings accounts offer simple interest, providing a fixed return based on the initial deposit without compounding.

- Short-Term Personal Loans - Lenders use simple interest to determine interest for short-duration personal loans, ensuring clarity in repayment amounts.

Understanding simple interest helps individuals manage loans and investments effectively in practical scenarios.

Benefits of Simple Interest

Simple interest offers straightforward calculation, making it easy to understand and predict earnings or costs over time. It applies only to the principal amount, avoiding complexities associated with compound interest.

Borrowers benefit from transparent costs, while investors enjoy clear, fixed returns. This simplicity supports effective financial planning and decision-making in various contexts.

Simple Interest in Daily Life

Simple interest plays a crucial role in everyday financial decisions, influencing loans, savings, and investments. Understanding how simple interest works helps individuals make smarter money choices and manage budgets effectively.

In daily life, simple interest is commonly applied to short-term loans, like personal loans or car loans, where the interest is calculated on the initial principal only. Savings accounts sometimes use simple interest to reward depositors, offering a clear and predictable return. Mastering simple interest concepts empowers people to compare financial products and avoid unnecessary costs.

Common Mistakes to Avoid

| Common Mistake | Description |

|---|---|

| Confusing Simple Interest with Compound Interest | Calculating interest on the principal only, without considering accumulated interest. |

| Ignoring the Time Period Units | Mixing different time units like months and years without proper conversion affects accuracy. |

| Incorrect Principal Amount | Using the wrong initial amount leads to errors in the calculated interest. |

| Misapplying the Interest Rate | Using annual interest rates for periods shorter or longer than one year without adjustment. |

| Forgetting to Convert Percentage | Omitting to convert the interest rate from percentage to decimal form before calculation. |