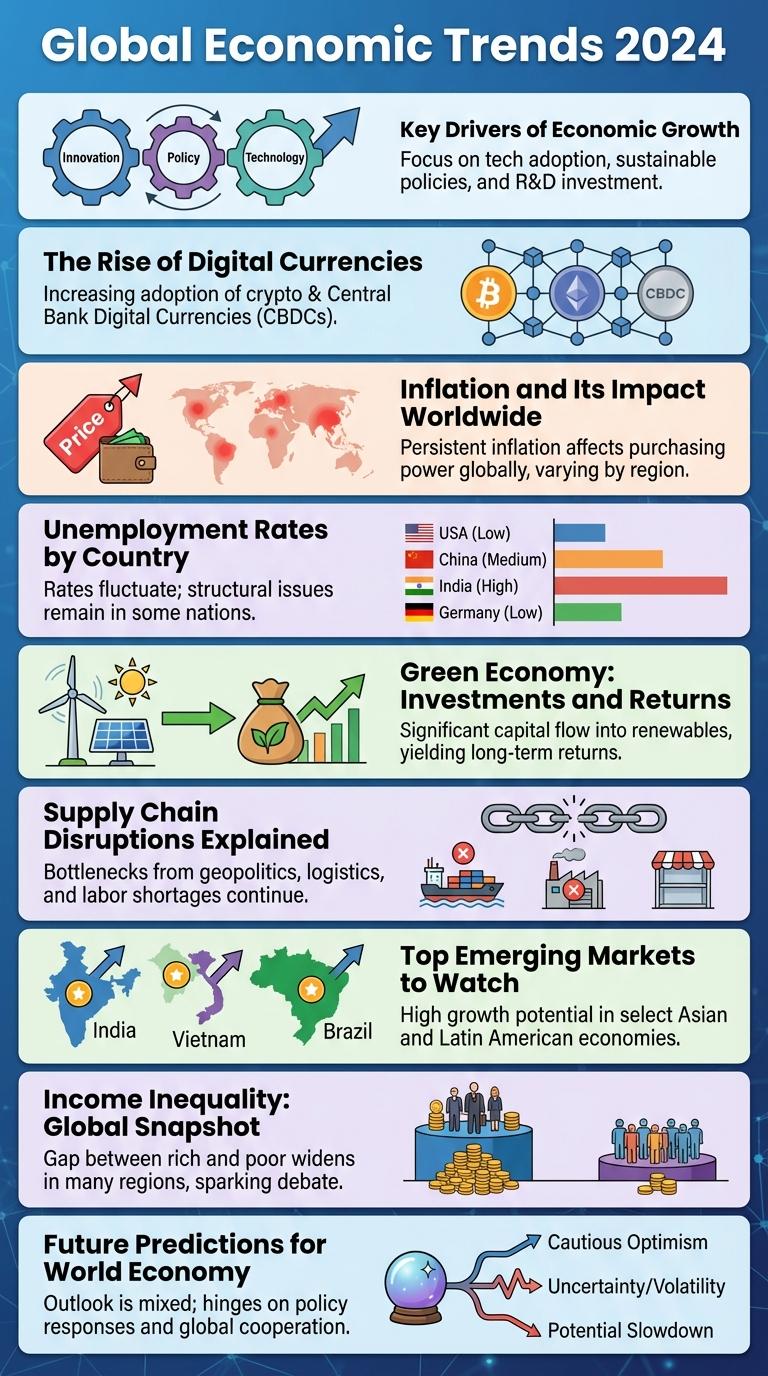

Visualizing economic trends through infographics simplifies complex data, making it accessible and engaging for diverse audiences. Key indicators such as GDP growth, unemployment rates, and inflation are presented clearly to highlight patterns and shifts in the economic landscape. This approach enhances understanding and supports informed decision-making in both business and policy contexts.

Global Economic Trends 2024

Global economic trends in 2024 indicate a steady recovery from the pandemic-induced downturn, with emerging markets leading growth at an estimated 4.5%. Inflation rates are expected to moderate globally, stabilizing consumer prices and boosting purchasing power. Technological advancements, especially in green energy and digital infrastructure, are driving investment and reshaping economic landscapes worldwide.

Key Drivers of Economic Growth

| Key Driver | Description |

|---|---|

| Investment in Infrastructure | Enhances productivity by improving transportation, communication, and utilities, fostering business expansion and job creation. |

| Technological Innovation | Boosts efficiency and creates new markets through advancements in automation, digital technology, and research development. |

| Human Capital Development | Improves workforce skills and education, increasing labor productivity and promoting sustainable economic progress. |

| Capital Accumulation | Increases available resources for production, enabling higher output and long-term economic growth. |

| Stable Economic Policies | Encourages investment and entrepreneurship by maintaining low inflation, fiscal discipline, and transparent governance. |

The Rise of Digital Currencies

Digital currencies have transformed the global economy by introducing decentralized financial systems. These currencies operate without central banks, allowing peer-to-peer transactions across borders.

The rise of Bitcoin, Ethereum, and other cryptocurrencies has accelerated digital adoption and blockchain technology integration. Businesses and governments increasingly explore digital currencies for efficiency and security.

Inflation and Its Impact Worldwide

Inflation represents the rate at which the general level of prices for goods and services rises, eroding purchasing power worldwide. Central banks monitor inflation closely to adjust monetary policies and stabilize economies.

High inflation impacts global markets by increasing costs for consumers and businesses, often leading to slower economic growth. Countries with volatile inflation rates experience challenges in investment, currency valuation, and long-term planning.

Unemployment Rates by Country

Unemployment rates vary significantly across countries, reflecting diverse economic conditions and labor market dynamics. Tracking these rates helps policymakers and investors gauge economic health and workforce stability.

Countries with strong economies often exhibit lower unemployment rates, signaling robust job creation and stable markets. In contrast, developing nations or those facing economic challenges tend to experience higher unemployment figures. Analyzing this data reveals trends crucial for global economic forecasting and policy formulation.

Green Economy: Investments and Returns

The green economy drives sustainable growth by investing in renewable energy, energy efficiency, and eco-friendly technologies. These investments yield measurable environmental and economic returns, supporting long-term prosperity.

- Global Green Investments Surged to $500 Billion in 2023 - Capital flow into renewable energy, sustainable agriculture, and clean technologies demonstrates increasing investor confidence.

- Renewable Energy Returns Exceed 7% Annually - Solar and wind projects consistently outperform traditional energy assets in financial returns.

- Green Economy Creates Over 30 Million Jobs Worldwide - Employment growth in clean sectors supports economic resilience and social development.

Investing in green sectors enables countries to reduce carbon emissions while fostering economic growth and stability.

Supply Chain Disruptions Explained

Supply chain disruptions have significantly impacted global economies, causing delays and increasing costs. Understanding the main causes helps businesses and consumers prepare for ongoing challenges.

Key factors behind supply chain breakdowns include labor shortages, transportation delays, and raw material scarcity.

- Labor Shortages - Reduced workforce availability slows manufacturing and logistics processes, leading to shipment delays.

- Transportation Bottlenecks - Limited freight capacity and port congestion restrict the movement of goods worldwide.

- Raw Material Scarcity - Supply constraints on essential materials disrupt production timelines and increase costs.

Top Emerging Markets to Watch

Emerging markets offer significant growth potential driven by rapid industrialization and expanding consumer bases. Key economies to watch include India, Brazil, Indonesia, Nigeria, and Vietnam, each showing strong GDP growth rates above the global average. These markets attract investments due to their increasing urbanization, technological adoption, and improving infrastructure.

Income Inequality: Global Snapshot

What does global income inequality look like in 2024? Income inequality remains a critical issue, with the richest 10% earning over 50% of the world's total income. The poorest 50% share less than 10%, highlighting vast disparities across continents.

| Income Group | Global Income Share |

|---|---|

| Top 10% | 50.4% |

| Top 1% | 21.3% |

| Bottom 50% | 9.7% |

| Middle 40% | 40% |

How do regions vary in income inequality today? North America and Europe exhibit moderate inequality compared to sharp divides in Africa and Latin America. Asia shows a mixed pattern, with some rapidly growing economies reducing gaps faster than others.