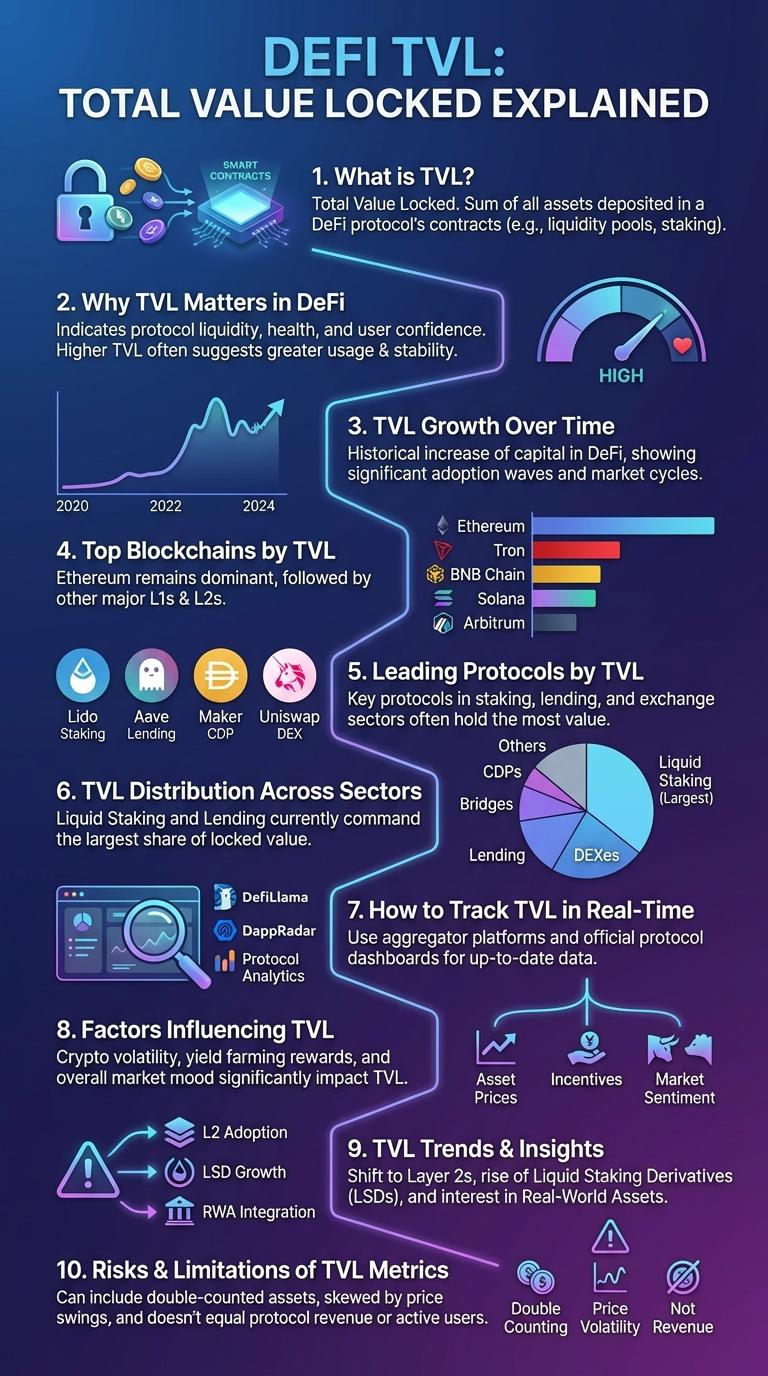

Tracking Total Value Locked (TVL) offers critical insights into the health and growth of decentralized finance (DeFi) ecosystems by measuring the amount of assets staked in protocols. Visualizing this data through an infographic simplifies complex trends, making it easier to grasp fluctuations and comparative values across platforms. Such representation aids investors and developers in identifying key opportunities and assessing market dynamics efficiently.

What is TVL?

Total Value Locked (TVL) represents the total amount of assets staked or locked in a decentralized finance (DeFi) platform's smart contracts. It is a key metric used to assess the size, liquidity, and overall health of DeFi projects. TVL reflects user confidence and the platform's ability to attract and retain funds.

Why TVL Matters in DeFi

Total Value Locked (TVL) represents the total assets staked or locked within DeFi protocols. It serves as a key indicator of a platform's liquidity, security, and overall market health.

High TVL signifies strong user trust and protocol adoption, influencing investment decisions and protocol rankings. Tracking TVL helps identify emerging trends and gauge the competitiveness of DeFi ecosystems.

TVL Growth Over Time

The infographic illustrates TVL (Total Value Locked) growth over a defined period, highlighting significant increases and trends. It captures daily and monthly TVL metrics to show the evolution of asset lockup in decentralized finance protocols. Visual elements emphasize peak periods, steady growth phases, and any noticeable dips or corrections.

Top Blockchains by TVL

Total Value Locked (TVL) measures the amount of crypto assets staked in decentralized finance (DeFi) protocols across various blockchains. Tracking TVL helps identify the most trusted and widely used blockchain platforms in the DeFi ecosystem.

- Ethereum leads in TVL - Ethereum hosts the largest number of DeFi projects, driving its position at the top of TVL rankings.

- Binance Smart Chain ranks second - Known for lower fees and faster transactions, Binance Smart Chain attracts significant TVL.

- Solana is a fast-growing contender - Solana's high throughput and low latency contribute to its rising TVL share.

Monitoring TVL trends reveals market confidence and user activity across the top blockchain networks.

Leading Protocols by TVL

Total Value Locked (TVL) measures the total assets staked in a DeFi protocol, indicating its market strength. Tracking leading protocols by TVL helps identify dominant platforms in decentralized finance.

These top protocols attract substantial liquidity and user engagement, reflecting trust and robust ecosystem growth.

- Uniswap - Uniswap leads with billions in TVL, serving as a major decentralized exchange for token swaps.

- Aave - Aave ranks high by offering a popular lending and borrowing platform backed by large collateral.

- Curve Finance - Curve Finance specializes in stablecoin trading and maintains significant TVL due to efficient liquidity pools.

TVL Distribution Across Sectors

TVL (Total Value Locked) is a key metric to measure the assets securely held within decentralized finance protocols across different sectors. Tracking TVL distribution helps highlight which sectors dominate the DeFi ecosystem and attract the most investment.

The TVL distribution spans sectors such as Lending, DEXs (Decentralized Exchanges), Derivatives, Yield Aggregators, and Infrastructure. Lending platforms typically command the highest TVL due to widespread use in borrowing and lending assets. DEXs follow closely, supported by high trading volumes and liquidity provision. Derivatives and yield aggregators capture smaller but growing shares as users seek advanced financial products and optimized returns.

How to Track TVL in Real-Time

Tracking Total Value Locked (TVL) in real-time provides insight into the liquidity and growth of DeFi platforms. Real-time TVL data allows investors to make informed decisions based on current market conditions.

Use dedicated analytics platforms like DeFi Pulse or DappRadar that aggregate TVL data across multiple blockchains. Connect these platforms to live blockchain nodes or APIs to ensure continuous updates and accuracy in tracking TVL.

Factors Influencing TVL

| Factor | Impact on TVL |

|---|---|

| Market Sentiment | Positive sentiment increases investor confidence, leading to higher TVL in DeFi platforms. |

| Interest Rates | Higher yields attract more deposits, boosting the total value locked across protocols. |

| Protocol Security | Strong security measures reduce risk, encouraging users to lock more assets. |

| Token Utility | Tokens with multiple use cases tend to increase TVL by incentivizing locking and staking. |

| Liquidity Incentives | Rewards such as staking bonuses and liquidity mining drive higher TVL engagement. |

TVL Trends & Insights

Total Value Locked (TVL) represents the cumulative assets staked in decentralized finance (DeFi) protocols, reflecting market confidence and platform growth. Tracking TVL trends offers insights into liquidity flow, user engagement, and ecosystem health.

Analyzing TVL trends over time reveals periods of rapid expansion, stabilization, or decline, influenced by market events and technological innovation.

- TVL Growth Peaks - Sharp increases in TVL often coincide with major protocol launches or incentive programs attracting liquidity providers.

- Seasonal TVL Variations - TVL fluctuates in response to market cycles, regulatory changes, and user adoption rates.

- Cross-Chain TVL Distribution - Shifts in TVL among multiple blockchains demonstrate diversification and evolving user preferences.