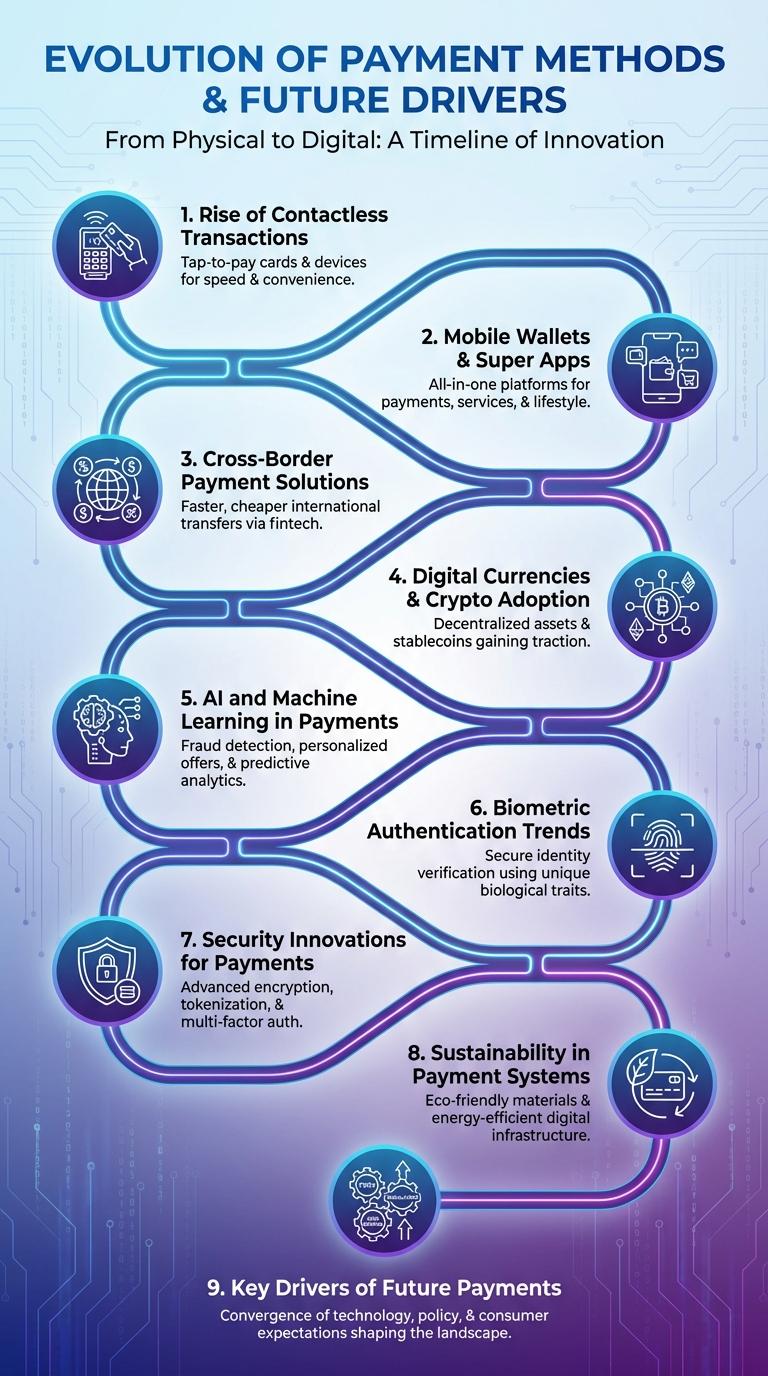

Future payment methods are rapidly evolving with advancements in technology, emphasizing speed, security, and convenience. Digital wallets, cryptocurrencies, and biometric authentication are shaping the new landscape of transactions. This infographic highlights key trends and innovations transforming how consumers and businesses handle payments.

Evolution of Payment Methods

| Era | Payment Methods |

|---|---|

| Prehistoric | Barter System - Direct exchange of goods and services |

| Ancient Times | Commodity Money - Use of gold, silver, and livestock as currency |

| Middle Ages | Coinage and Paper Money - Standardized coins and early banknotes |

| 20th Century | Credit Cards and Electronic Payments - Introduction of plastic cards, online banking, and ATMs |

| 21st Century & Beyond | Mobile Payments, Cryptocurrencies, and Biometric Authentication - Digital wallets, blockchain technology, facial recognition |

Key Drivers of Future Payments

The future of payments is shaped by rapid technological advancements and evolving consumer expectations. Understanding the key drivers helps businesses and consumers adapt to seamless and secure transactions.

- Digital Wallets: Increasing adoption of mobile and contactless payments enhances convenience and speed.

- Blockchain Technology: Decentralized ledgers provide transparency and security in transactions.

- Artificial Intelligence: AI enables fraud detection and personalized payment experiences.

Rise of Contactless Transactions

Contactless transactions are revolutionizing the payment landscape, offering speed and convenience. Consumers increasingly prefer tap-to-pay methods over traditional cash or card swipes.

Global contactless payments are projected to exceed $6 trillion by 2025, driven by smartphone wallets and NFC-enabled devices. Retailers are investing in contactless infrastructure to meet this growing demand. Enhanced security features, such as tokenization and biometric authentication, build trust and reduce fraud risk.

Digital Currencies & Crypto Adoption

Digital currencies and cryptocurrency adoption are transforming the future of payments by enabling faster, more secure transactions worldwide. Growing interest from consumers, businesses, and governments drives this shift toward decentralized financial systems.

- Rising Crypto Adoption - Over 300 million people globally used cryptocurrency wallets by 2023, reflecting widespread user acceptance.

- Central Bank Digital Currencies (CBDCs) - More than 80 countries are exploring or piloting CBDCs to modernize payment infrastructure and enhance financial inclusion.

- Blockchain Payment Infrastructure - Blockchain technology underpins secure, transparent payment networks that reduce transaction costs and processing times.

Future payments will increasingly leverage digital currencies to provide seamless, borderless financial experiences for users worldwide.

AI and Machine Learning in Payments

How is AI transforming the future of payments?

Artificial Intelligence enhances payment security by detecting fraudulent activities in real-time. Machine Learning algorithms analyze transaction patterns, reducing false declines and improving customer experience.

What role does Machine Learning play in payment personalization?

Machine Learning models tailor payment options based on individual user behavior and preferences. This personalization increases transaction success rates and promotes customer loyalty.

How does AI improve payment fraud detection?

AI systems continuously learn from new fraud patterns to identify suspicious transactions faster than traditional methods. This leads to significant reductions in financial losses for businesses and consumers.

Can AI optimize payment processing speeds?

AI-driven automation accelerates transaction approvals by minimizing manual intervention. Faster processing reduces checkout times, enhancing overall user satisfaction.

What are the benefits of AI-powered predictive analytics in payments?

Predictive analytics forecast payment trends and potential risks, allowing businesses to proactively manage resources. This enables smarter decision-making and improved financial forecasting.

Biometric Authentication Trends

Biometric authentication is revolutionizing the future of payment systems by enhancing security and user convenience. This trend is set to drive widespread adoption across various financial platforms globally.

- Increased Adoption - Over 70% of digital payment users are expected to use biometric authentication by 2026.

- Multi-Modal Biometrics - Combining fingerprint, facial recognition, and voice authentication improves verification accuracy.

- Regulatory Support - Governments and financial authorities are endorsing biometric standards to reduce fraud and enhance compliance.

Mobile Wallets & Super Apps

Mobile wallets are transforming how consumers conduct transactions by offering fast, secure, and contactless payment options. Enhanced convenience drives widespread adoption across retail, transportation, and hospitality sectors.

Super apps integrate various services including payments, messaging, and shopping into one platform, creating seamless user experiences. Markets in Asia and Latin America lead in super app usage, impacting future payment ecosystems globally.

Security Innovations for Payments

Security innovations for future payment systems focus on enhancing protection against fraud and unauthorized access. Advanced technologies like biometric authentication and blockchain are transforming how transactions are secured.

Biometric methods, including fingerprint and facial recognition, provide unique user verification, reducing reliance on passwords. Blockchain ensures transparency and immutability, making payment records tamper-proof and fostering trust.

Cross-Border Payment Solutions

Cross-border payment solutions are revolutionizing international trade by enabling faster, secure, and cost-effective transactions across global markets. Emerging technologies such as blockchain and AI enhance transparency and reduce settlement times, minimizing currency exchange risks. Businesses leverage these innovations to streamline operations, improve cash flow, and expand their global reach efficiently.