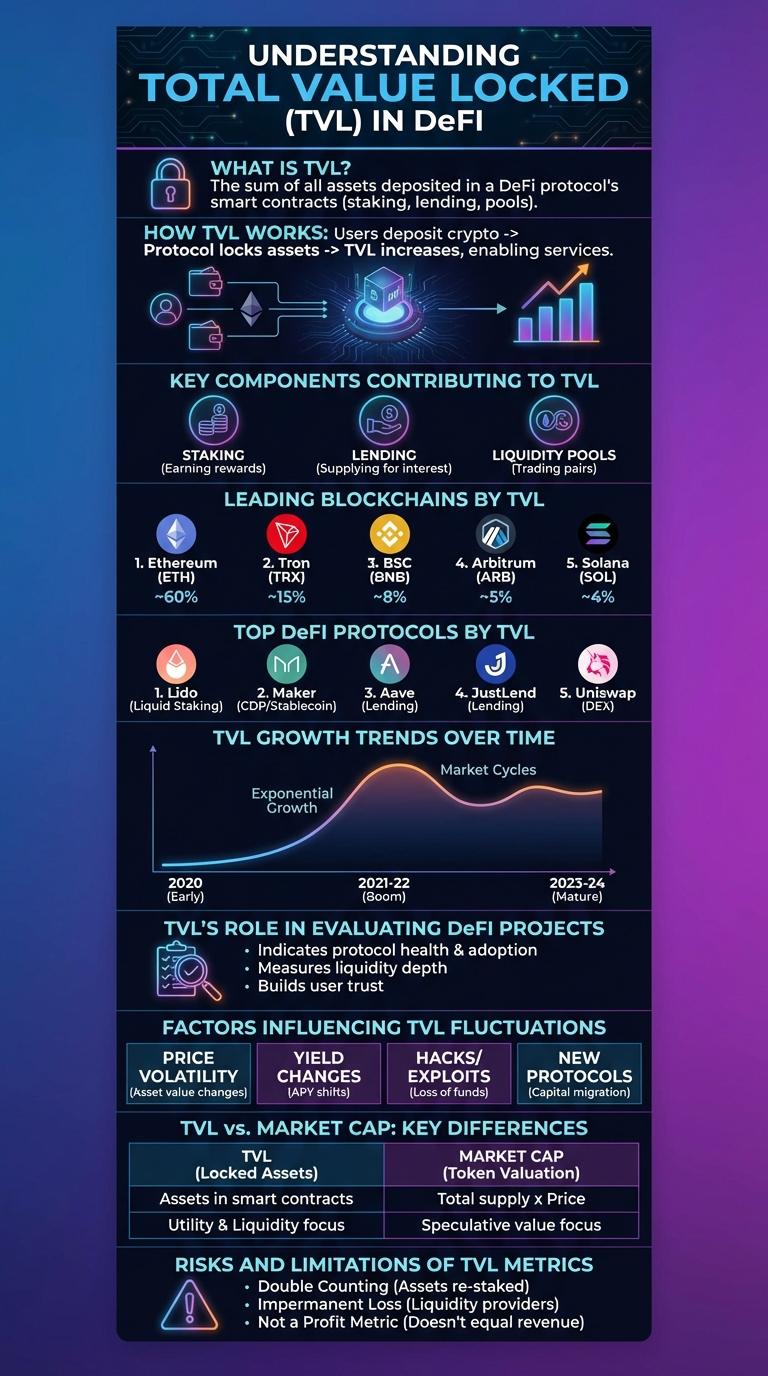

TVL, or Total Value Locked, measures the total assets secured in a decentralized finance (DeFi) protocol, reflecting its overall health and trustworthiness. The infographic breaks down TVL trends across various platforms, highlighting growth patterns and liquidity distribution. Understanding TVL helps investors gauge market confidence and protocol stability in the evolving DeFi landscape.

What is TVL (Total Value Locked)?

Total Value Locked (TVL) measures the total assets staked or locked in a decentralized finance (DeFi) protocol. It reflects the overall health and adoption of DeFi platforms by quantifying the amount of cryptocurrency committed.

- Definition - TVL represents the aggregate value of all cryptocurrencies locked in smart contracts within a DeFi platform.

- Importance - TVL indicates the trust and usage level of a protocol, serving as a key metric for investors and developers.

- Calculation - TVL is calculated by summing the market value of all tokens deposited in the protocol's contracts.

A higher TVL suggests greater liquidity, security, and user confidence in a DeFi ecosystem.

How TVL Works in DeFi

Total Value Locked (TVL) measures the total assets staked or locked within DeFi protocols, indicating the health and liquidity of the platform. TVL is calculated by summing the value of all cryptocurrencies deposited in smart contracts across lending, staking, and yield farming services. Higher TVL signals greater trust and usage, attracting more users and liquidity providers in decentralized finance ecosystems.

Key Components Contributing to TVL

| Component | Impact on TVL |

|---|---|

| Liquidity Pools | Core source of TVL; funds locked in pools enable trading, lending, and borrowing. |

| Staking Contracts | Assets committed to staking enhance security and often increase TVL by locking tokens. |

| Yield Farming | Incentivizes users to lock assets in protocols to generate returns, boosting overall TVL. |

| Wrapped Assets | Tokenized versions of assets on different chains expand TVL by cross-chain liquidity. |

| Derivatives & Synthetic Assets | Financial instruments representing underlying assets add layers to the total locked value. |

Leading Blockchains by TVL

Total Value Locked (TVL) measures the capital secured in decentralized finance protocols across various blockchains. Leading blockchains by TVL demonstrate their dominance and user trust in DeFi ecosystems.

- Ethereum dominates TVL - It holds the largest share due to its extensive DeFi applications and active developer community.

- Binance Smart Chain ranks high - Known for low fees and fast transactions, it attracts substantial TVL in DeFi projects.

- Solana gains traction - Its high throughput and scalability contribute to growing TVL and expanding user base.

Top DeFi Protocols by TVL

Total Value Locked (TVL) measures the amount of assets staked in DeFi protocols, reflecting their adoption and liquidity. It serves as a key indicator of the health and growth of decentralized finance platforms.

Leading DeFi protocols dominate TVL rankings, showcasing their influence in the ecosystem. These platforms attract significant capital through decentralized lending, trading, and yield farming services.

TVL Growth Trends Over Time

Total Value Locked (TVL) in DeFi protocols has experienced significant growth over the past few years, reflecting increasing user adoption and capital inflows. Tracking TVL trends provides valuable insights into market dynamics and platform performance.

From early 2020 to mid-2024, TVL surged from under $1 billion to peaks exceeding $100 billion across various blockchain ecosystems. Periods of rapid expansion align with the rise of new protocols, yield farming, and cross-chain integrations. Temporary declines often coincide with market corrections or regulatory uncertainties, highlighting the volatile yet promising nature of the DeFi space.

TVL's Role in Evaluating DeFi Projects

Total Value Locked (TVL) represents the cumulative amount of assets staked in a DeFi protocol, serving as a key indicator of its market traction and user trust. Higher TVL signifies greater liquidity, which improves trading efficiency and reduces slippage for users. Investors and analysts rely on TVL metrics to assess the relative strength and growth potential of decentralized finance projects.

Factors Influencing TVL Fluctuations

Total Value Locked (TVL) represents the total assets staked or locked in a decentralized finance (DeFi) protocol, measuring its overall health and user trust. TVL fluctuations indicate changes in user activity, asset price volatility, and market sentiment.

Understanding the factors influencing TVL helps investors and developers make informed decisions in the DeFi ecosystem.

- Market Price Volatility - Fluctuations in cryptocurrency prices directly impact TVL, as asset value changes alter the total locked capital.

- User Activity Levels - Increased deposits or withdrawals by users cause TVL to rise or fall reflecting engagement and confidence.

- Protocol Upgrades and Security - Enhancements or vulnerabilities in a protocol can influence user trust, thereby affecting TVL trends.

TVL vs. Market Cap: Key Differences

What distinguishes TVL from Market Cap in decentralized finance?

TVL (Total Value Locked) reflects the total assets committed within a DeFi protocol, showcasing liquidity and user trust. Market Cap measures the overall value of a cryptocurrency based on its circulating supply and current price, indicating market valuation.